Jm financial mutual fund common application form with kim

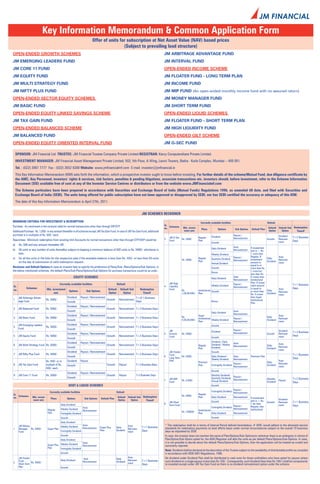

- 1. Trust is always the answer Key Information Memorandum & Common Application Form Offer of units for subscription at Net Asset Value (NAV) based prices (Subject to prevailing load structure) OPEN-ENDED GROWTH SCHEMES JM ARBITRAGE ADVANTAGE FUND JM EMERGING LEADERS FUND JM INTERVAL FUND JM CORE 11 FUND OPEN-ENDED INCOME SCHEME JM EQUITY FUND JM FLOATER FUND - LONG TERM PLAN JM MULTI STRATEGY FUND JM INCOME FUND JM NIFTY PLUS FUND JM MIP FUND (An open-ended monthly income fund with no assured return) OPEN-ENDED SECTOR EQUITY SCHEMES JM MONEY MANAGER FUND JM BASIC FUND JM SHORT TERM FUND OPEN-ENDED EQUITY LINKED SAVINGS SCHEME OPEN-ENDED LIQUID SCHEMES JM TAX GAIN FUND JM FLOATER FUND - SHORT TERM PLAN OPEN-ENDED BALANCED SCHEME JM HIGH LIQUIDITY FUND JM BALANCED FUND OPEN-ENDED GILT SCHEME OPEN-ENDED EQUITY ORIENTED INTERVAL FUND JM G-SEC FUND SPONSOR: JM Financial Ltd. TRUSTEE: JM Financial Trustee Company Private Limited REGISTRAR: Karvy Computershare Private Limited. INVESTMENT MANAGER: JM Financial Asset Management Private Limited, 502, 5th Floor, A Wing, Laxmi Towers, Badra - Kurla Complex, Mumbai – 400 051. Tel. : (022) 3987 7777 Fax : (022) 2652 8388 Website: www.jmfinancialmf.com E-mail: investor@jmfinancial.in This Key Information Memorandum (KIM) sets forth the information, which a prospective investor ought to know before investing. For further details of the scheme/Mutual Fund, due diligence certificate by the AMC, Key Personnel, investors’ rights & services, risk factors, penalties & pending litigations, associate transactions etc. investors should, before investment, refer to the Scheme Information Document (SID) available free of cost at any of the Investor Service Centres or distributors or from the website www.JMFinancialmf.com The Scheme particulars have been prepared in accordance with Securities and Exchange Board of India (Mutual Funds) Regulations 1996, as amended till date, and filed with Securities and Exchange Board of India (SEBI). The units being offered for public subscription have not been approved or disapproved by SEBI, nor has SEBI certified the accuracy or adequacy of this KIM. The date of this Key Information Memorandum is April 27th, 2011. JM SCHEMES RECKONER MINIMUM CRITERIA FOR INVESTMENT & REDEMPTION Currently available facilities Default Purchase : As mentioned in the reckoner table for normal transactions other than through SIP/STP. Sr. Schemes Min. invest- Default Default Sub Redemption no. Plans Options Sub Options Default Plan Additional Purchase : Rs. 1,000/- or any amount thereafter in all schemes except JM Tax Gain Fund. In case of JM Tax Gain Fund, additional ment amt. Option Option Time# purchase is in multiples of Rs. 500/- each. Payout / Dividend JM G Sec Regular Dividend T+2 Business 3 Rs. 5000/ Reinvestment - Growth Reinvest- Repurchase : Minimum redemption from existing Unit Accounts for normal transactions other than through STP/SWP would be Fund Plan Days Growth ment a) Rs. 500 and any amount thereafter OR Auto If investment b) 50 units or any number of units thereafter subject to keeping a minimum balance of 500 units or Rs. 5000/- whichever is Daily Dividend Reinvestment amt is < Rs. less. Weekly Dividend 1 crore then Payout / Regular; If Auto c) for all the units in the folio for the respective plan if the available balance is less than Rs. 500/- or less than 50 units Rs. 5000/- Regular Quarterly Dividend investment Daily Reinvest- Plan Reinvestment Dividend on the day of submission of valid redemption request. Annual Dividend amount is ment equal to or Reckoner and Default Options:In case an investor fails to specify his preference of Plans/Sub- Plans/Options/Sub-Options, in Growth more than Rs. the below mentioned schemes, the default Plans/Sub-Plans/Options/Sub-Options for purchase transactions would be as under : 1 crore but Bonus less than Rs. EQUITY SCHEMES Daily Dividend Auto 5 crores then Reinvestment Institutional JM High Plan. If invest- Currently available facilities Default Payout / ment amount T+1 Business Sr. 4 Liquidity Weekly Dividend Schemes Reinvestment Days Min. investment Default Default Sub Redemption Fund is equal to Auto no. Options Sub Options Rs. Institutional Growth Daily or more than Reinvest- amt. Option Option Time# 1,00,00,000/- Plan Dividend Rs. 5 crores ment JM Arbitrage Advan- Dividend Payout / Reinvestment T+3(*) Business then Super 1 Rs. 5000/- Growth Reinvestment Institutional tage Fund Growth Days Bonus Plan Dividend Payout / Reinvestment - 2 JM Balanced Fund Rs. 5000/- Growth Reinvestment T+3 Business Days Growth Auto Daily Dividend Reinvestment Dividend Payout / Reinvestment Super Auto 3 JM Basic Fund Rs. 5000/- Growth Reinvestment T+3 Business Days Rs. Daily Institutional Payout / Reinvest- Growth 5,00,00,000/- Plan Weekly Dividend Reinvestment Dividend ment JM Emerging Leaders Dividend Payout / Reinvestment Growth 4 Rs. 5000/- Growth Reinvestment T+3 Business Days Fund Growth JM Payout / Dividend Dividend T+2 Business Dividend Payout / Reinvestment 5 Income Rs. 5000/- - Reinvestment Growth Reinvest- 5 JM Equity Fund Rs. 5000/- Growth Reinvestment T+3 Business Days Fund ment Days Growth Growth Dividend Payout / Reinvestment Dividend / Daily Auto Auto 6 JM Multi Strategy Fund Rs. 5000/- Growth Reinvestment T+3 Business Days Regular Dividend / Weekly Daily Growth Reinvestment Reinvest- Plan Dividend Dividend ment Dividend Payout / Reinvestment JM Floater Growth 7 JM Nifty Plus Fund Rs. 5000/- Growth Reinvestment T+3 Business Days Fund - T+1 Business Growth 6 Long Term Rs. 5000/- Daily Dividend / Auto Premium Plan Weekly Dividend Reinvestment Days Rs. 500/- or in Dividend Payout Plan Auto Premium Daily 8 JM Tax Gain Fund multiple of Rs. Growth Payout T+3 Business Days Payout / Reinvest- Growth Plan Fortnightly Dividend Dividend Reinvestment ment 500/- each Growth Dividend Payout / Reinvestment 9 JM Core 11 Fund Rs. 5000/- Growth Payout T+3 Business Days Monthly Dividend/ Growth Payout / JM MIP Quarterly Dividend/ Monthly T+2 Business 7 Rs. 5,000/- - Reinvestment - Payout Fund Annual Dividend Dividend Days DEBT & LIQUID SCHEMES Growth Payout / Currently available facilities Default Fortnightly Dividend Reinvestment Sr. Regular Schemes Rs. 5000/ no. Min. invest- Default Default Sub Redemption Plan Daily Dividend Reinvestment If investment Plans Options Sub Options Default Plan Dividend ment amt. Option Option Time# amt is < Rs. JM Short Growth Growth Reinvest- T+1 Business Daily Dividend 8 1 lac then Term Fund Payout / ment Days Auto Fortnightly Dividend Regular, else Regular Weekly Dividend Reinvestment Institutional Reinvestment Institutional Plan Rs. 100000/ Fortnightly Dividend Plan Daily Dividend Reinvestment Growth Growth Daily Dividend JM Money Weekly Dividend Auto Auto * The redemption shall be in terms of Interval Period defined hereinbelow. # AMC would adhere to the aforesaid service Reinvestment Super Plus Daily T+1 Business standards for redemption payments on best efforts basis under normal circumstances subject to the overall 10 business 1 Manager Rs. 5000/- Super Plan Reinvest- Fortnightly Dividend Plan Dividend Days days as stipulated by SEBI. Fund ment Growth In case, the investor does not mention the name of Plan/Options/Sub-Options/or wherever there is an ambiguity in choice of Daily Dividend Plan/Option/Sub-Option opted for, the AMC/Registrar will allot the units as per default Plans/Options/Sub-Options. In case, Auto it is not possible to decide about the default Plans/Options/Sub-Options, then the application will be treated as invalid and Super Plus Weekly Dividend Reinvestment summarily rejected. Plan Fortnightly Dividend Note: Dividend shall be declared at the descretion of the Trustee subject to the availability of distributable profits as compiled Growth in accordance with SEBI (MF) Regulations, 1996. JM Floater Auto No dividend under Dividend Plan shall be distributed in cash even for those unitholders who have opted for payout where Auto Daily Fund - Daily Dividend - Reinvest- T+1 Business such dividend on a single payout is less than Rs.100/-. Consequently, such dividend (less than Rs.100/-) shall be compulsorily 2 Rs. 5000/- Reinvestment Dividend Short Term ment Days re-invested except under JM Tax Gain Fund as there is no dividend reinvestment option under the scheme. Plan Growth

- 2. Trust is always the answer HIGHLIGHTS OF THE SCHEME(S) Name(s) of the Scheme(s) JM Equity Fund JM Emerging Leaders Fund JM Multi Strategy Fund Type of Scheme An open-ended growth scheme An open-ended equity oriented growth scheme An open ended equity oriented scheme Investment Objective To provide optimum Capital growth and appreciation. To seek long term capital appreciation from investment in a portfolio of stocks To provide capital appreciation by investing in equity and equity related securities using across all market capitalization range. The portfolio may include those companies However, there can be no assurance that the investment objectives of operating in emerging sectors of the economy or companies which exhibit potential a combination of strategies the Scheme will be realized. The Scheme does not guarantee/indicate any to become leaders of tomorrow. returns. However, there can be no assurance that the investment objectives of the Scheme will be realized. The Scheme does not guarantee/indicate any returns. Investment Strategy JM Equity Fund seeks to invest a substantial portion of its portfolio in equity Under normal circumstances, the corpus would be invested in equities and equity The Scheme proposes to invest primarily in equities and equity related securities using and equity related instruments. Under normal circumstances, around 80% oriented securities of companies across all sectors and market cap range.The a combination of strategies. Depending on the prevailing market conditions, the Scheme of the corpus shall be deployed in such securities and the balance in debt/ Scheme’s investment strategy would be to utilize the extensive research resources will either adopt the growth or value style of investing. During benign market conditions, money market instruments. However, whenever the valuations of securities to identify stocks across market capitalizations and across sectors. The investment the Scheme will act like an aggressive growth fund with a concentrated portfolio of say rise in a sharp manner, the AMC will take advantage of trading opportunities universe of this Scheme shall comprise of stocks from all market capitalisation 25 – 30 stocks with a targeted portfolio beta of greater than 1 whereas in a bearish presented and in such a scenario, the Fund will have a high turnover rate. range viz., large cap, mid cap and small cap as defined which may be across all market the Scheme will have a low volatility conservative portfolio of larger number of sectors. The fund will seek to use predominantly a bottom-up research approach stocks in the range of 40 to 60 stocks with a targeted portfolio beta of less than 1. to select stocks in the emerging sectors of the economy and companies which have the potential to become tomorrow’s leaders. The Scheme could also invest in stocks that attract a low Price-Earnings multiple relative to peers in the same sector and have the potential to deserve a higher multiple due to structural changes in business environment. The Scheme could have a high portfolio turnover ratio and is suitable for investors having a reasonably longer investment horizon. Asset Allocation Pattern of Type of Instruments Normal Allocation Risk Type of Instruments Normal Allocation Risk Profile the Scheme Type of Instruments Normal Allocation (% of net assets) Profile (% of net assets) Risk Profile (% of net assets) Equity 80% to 100% High Equity & equity related instruments** 80% to 100% Medium to High Equity & equity related instruments (including Medium to 65% to 100% Money market instruments / Debt* 0% to 20% Low to Medium equity derivatives)** High Debt, Money market and short term Low 0% to 20% Money market instruments / debt securities Low to debt inst maturing within one year **The notional value of derivatives shall not exceed the AUM of the scheme. 0% to 35% (including securitized debt* to the extent of 20%) Medium The notional value of derivatives shall not exceed the AUM of the scheme. * including securitized debt upto a maximum of 20% of net assets of this scheme. For short term period on defensive consideration the scheme may invest upto 100% **The notional value of derivatives shall not exceed the AUM of the scheme. of the funds available in overnight interbank call/notice money and/or repos, the * excluding foreign securitized debt. primary motive being to protect the Net Asset Value of the Scheme and protect The AMC intends to invest in derivative instruments in accordance with the SEBI unitholders interest so also to earn reasonable returns on liquid funds maintained Regulations, as and when opportunities arise in the derivatives markets. The investment for redemption/ repurchase of units. in derivatives will be broadly in line with the investment objective of the Scheme. Risk Profile of the Scheme Mutual Fund Units involve investment risks including the possible loss of Mutual Fund Units involve investment risks including the possible loss of principal. Mutual Fund Units involve investment risks including the possible loss of principal. Please principal. Please read the SID carefully for details on risk factors before Please read the SID carefully for details on risk factors before investment. read the SID carefully for details on risk factors before investment. investment. Plans and Options Dividend (Payout & Reinvestment option) & Growth Dividend (Payout & Reinvestment option) & Growth Dividend Plan (Payout & Reinvestment option) & Growth Plan Applicable NAV Details are set out in subsequent pages. Details are set out in subsequent pages. Details are set out in subsequent pages. Minimum Application Refer JM SCHEMES RECKONER on page 1 Refer JM SCHEMES RECKONER on page 1 Refer JM SCHEMES RECKONER on page 1 Amount / No. of Units Dispatch of Repurchase / Details are set out in subsequent pages. Details are set out in subsequent pages. Details are set out in subsequent pages. Redemption request Benchmark Index BSE Sensex BSE 200 Index BSE 500 Index Dividend Policy Details are set out in subsequent pages. Details are set out in subsequent pages. Details are set out in subsequent pages. Name of the Fund Manager Sanjay Chhabaria Asit Bhandarkar Sanjay Chhabaria Performance of the Scheme Compounded annualized returns (%) of Growth option as on March 31, 2011. Compounded annualized returns (%) of Growth option as on March 31, 2011. Compounded annualized returns (%) of Growth option as on March 31, 2011. Compounded annualized returns Returns 1 year 3 years 5 years Since inception* Returns Returns 1 year 3 years 5 years Since inception* 1 year Since inception* JM Equity Fund 5.39 (2.43) 2.40 8.50 JM Emerging Leaders Fund JM Multi Strategy Fund (7.97) (16.21) (9.95) (1.98) (5.57) 14.63 BSE 500 Index 7.48 15.35 BSE Sensex 10.94 7.52 11.50 11.80 BSE 200 Index 8.15 7.17 10.98 16.85 * Date of inception = Date of allotment i.e. 23.09.2008 * Date of inception = Date of allotment i.e. 01.04.1995 * Date of inception = Date of allotment i.e. 27.07.2005 Note: Compounded Annualised Growth Returns (CAGR) for period 1 year or more, with Note: Compounded Annualised Growth Returns (CAGR) for period 1 year or Note: Compounded Annualised Growth Returns (CAGR) for period 1 year or more, more, with reinvestment of dividends (if any). Past performance may or may with reinvestment of dividends (if any). Past performance may or may not be reinvestment of dividends (if any). Past performance may or may not be sustained in sustained in future. future. not be sustained in future. 100.00 150.00 100.00 JM Equity - Growth BSE Sensex JM Emerging Leaders Fund - Growth BSE200 JM Multi Strategy Fund - Growth BSE 500 80.00 100.00 80.00 60.00 60.00 Returns% Returns% 40.00 50.00 Returns% 20.00 FY 08-09 40.00 FY 08-09 0.00 0.00 20.00 FY 10-11 FY 09-10 FY 07-08 FY 06-07 FY 10-11 FY 09-10 FY 07-08 FY 06-07 -20.00 -50.00 0.00 -40.00 FY 10-11 FY 09-10 -100.00 -20.00 -60.00 Entry Load NIL NIL NIL Exit Load 1.00% of NAV on all investment (including SIP/ STP/ SWP) transactions, if 1.00% of NAV on all investment (including SIP/ STP/ SWP) transactions, if redeemed 1.00% of NAV on all investment (including SIP/ STP/ SWP) transactions, if redeemed redeemed / switched-out within 365 days of transfer/ allotment of units in / switched-out within 365 days of transfer/ allotment of units in normal transactions/ / switched-out within 365 days of transfer/ allotment of units in normal transactions/ normal transactions/ allotment of units of respective installments in SIP/ STP/ allotment of units of respective installments in SIP/ STP/ SWP transactions. allotment of units of respective installments in SIP/ STP/ SWP transactions. SWP transactions. (ii) Recurring expenses First Rs.100 Next Rs.300 Next Rs. 300 For the Balance First Rs.100 Next Rs.300 Next Rs. 300 For the Balance [% of Net Assets] First Rs. 100 Next Rs. 300 Next Rs. 300 For the Balance crores crores crores Assets crores crores crores Assets Crores Crores Crores Assets 2.50% 2.25% 2.00% 1. 75% 2.50% 2.25% 2.00% 1.75% 2.50% 2.25% 2.00% 1.75% Actual Expenses for the period 1st April 2010 to 31st March 2011: 2.50% Actual Expenses for the period 1st April 2010 to 31st March 2011 : 2.38% Actual Expenses for the period 1st April 2010 to 31st March 2011 : 2.50% No. of Folios as on 31.03.2011 10170 27882 7921 Quarterly Avg. AUM (In 28.13 140.43 21.73 Crores) - Jan 11 to Mar 11 HIGHLIGHTS OF THE SCHEME(S) Name(s) of the Scheme(s) JM Core 11 Fund JM Nifty Plus Fund JM Basic Fund Type of Scheme An open ended equity oriented scheme An open-ended equity oriented scheme An open-ended sector scheme Investment Objective To provide long-term growth by investing predominantly in a concentrated To outperform the benchmark by predominantly investing in the constituents To its Unitholders through judicious deployment of the corpus of the Scheme in sectors portfolio of equity / equity related instruments of companies. of S & P CNX Nifty in the same weightages as in its composition and through categorized under “basic industry” in the normal parlance and in context of the Indian deployment of surplus cash in debt and money market instruments and derivative economy, including but not limited to, energy, petrochemicals, oil & gas, power instruments. generation & distribution, electrical equipment suppliers, metals and building material. However, there can be no assurance that the investment objective of the scheme The fund would continue to remain open-ended with a sector focus. will be realized. The scheme does not guarantee/indicate any returns. However, there can be no assurance that the investment objectives of the Scheme will be realized. The Scheme does not guarantee/indicate any returns. Investment Strategy The Scheme will have a concentrated portfolio with not more than 11 stocks The JM Nifty Plus will be a fund, where the scheme will endeavor to provide Under normal circumstances, the corpus would be invested in equities and equity type in the portfolio with each stock being invested to the extent of 9.09% of the returns better than the benchmark. Hence the Fund will at all times be deployed securities categorized under “basic industry” in the normal parlance and in context of NAV of the Scheme. The portfolio will be rebalanced on a fortnightly basis so with a minimum of 65% and maximum upto 100% of the corpus into Nifty 50 the Indian economy, including but not limited to, energy, petrochemicals, oil & gas, as to prevent any one stock going above the targeted concentration range. shares, in the same weightages as its composition thus maintaining the equity power generation & distribution and electrical equipment suppliers, metals and building To prevent stagnancy of the portfolio, the portfolio will be reviewed on a status of the Fund. materials. The fund would continue to remin open-ended with a sector focus. Exposure half yearly basis whereby some stocks would be replaced. Besides that in times when there are good investment opportunities, the following of investment in individual scrip if part of the Sectoral Index shall not be restricted to strategies may be followed which will endeavor to provide additional returns : 10% of NAV as Clause 10 of Seventh Schedule of SEBI Regulations has clarified that a) Arbitrage Opportunities the limit of 10 percent shall not be applicable for investments in index fund or sector b) Ratio/Spread Trades. or industry specific scheme. c) Option Strategies. Asset Allocation Pattern of the Maximum Type of Instruments Normal Allocation Security Risk Profile Type of Instruments Normal Allocation Scheme Risk Profile Exposure (%) Risk Profile (% of net assets) (% of net assets) Equity stocks comprising the S&P CNX Equity and equity related 65 - 100 High 65% to 100% Medium to High Nifty Index Equity & equity related securities# Equity Derivatives 0 – 50 High instruments (including equity 80% to 100% High Money Market Instruments derivatives) 0% to 35% Low to Medium Debt & Money Market Instruments / Debt 0 - 35 Low to Medium (including securitised debt) Debt securities & Money market The Scheme will not invest in securitized debt. 0% to 20% Low instruments The notional value of derivatives shall not exceed the AUM of the scheme. # Exposure to derivatives would be capped at 50 % of equity portfolio of the Securitised Debt 0% to 20% Low Scheme. The cumulative gross exposure through equity, debt and derivative positions will not exceed 100% of the net assets of the Scheme. The Trustee may, from time to time, pending deployment of funds of the Scheme in securities in terms of the investment objective of the Scheme, invest the funds of the Scheme in short-term deposits of scheduled commercial banks in accordance with SEBI Circular No. SEBI/IMD/CIR No. 1/91171/07 dated April 16, 2007, as amended. Risk Profile of the Scheme Mutual Fund Units involve investment risks including the possible loss of Mutual Fund Units involve investment risks including the possible loss of principal. Mutual Fund Units involve investment risks including the possible loss of principal. Please principal. Please read the SID carefully for details on risk factors before Please read the SID carefully for details on risk factors before investment. read the SID carefully for details on risk factors before investment. investment. Plans and Options Dividend Plan (Payout & Reinvestment option) & Growth Plan Dividend Plan (Payout & Reinvestment option) & Growth Plan. Dividend Plan (Payout & Reinvestment option) & Growth Plan Applicable NAV Details are set out in subsequent pages. Details are set out in subsequent pages. Details are set out in subsequent pages. Minimum Application Amount Refer JM SCHEMES RECKONER on page 1 Refer JM SCHEMES RECKONER on page 1 Refer JM SCHEMES RECKONER on page 1 / No. of Units Dispatch of Repurchase / Details are set out in subsequent pages. Details are set out in subsequent pages. Details are set out in subsequent pages. Redemption request w.e.f. November 1, 2010 , the benchmark index of JM Basic Fund has been changes Benchmark Index BSE Sensex S&P CNX Nifty Index to BSE 200 from BSE Basic Industries Index (Disclaimer Pls refer Pg no. 11. 2