International Metals Trading, LLC 506c Offering Memorandum

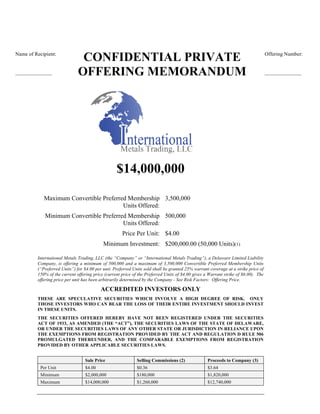

- 1. CONFIDENTIAL PRIVATE OFFERING MEMORANDUM $14,000,000 Maximum Convertible Preferred Membership Units Offered: 3,500,000 Minimum Convertible Preferred Membership Units Offered: 500,000 Price Per Unit: $4.00 Minimum Investment: $200,000.00 (50,000 Units)(1) International Metals Trading, LLC (the “Company” or “International Metals Trading”), a Delaware Limited Liability Company, is offering a minimum of 500,000 and a maximum of 3,500,000 Convertible Preferred Membership Units (“Preferred Units”) for $4.00 per unit. Preferred Units sold shall be granted 25% warrant coverage at a strike price of 150% of the current offering price (current price of the Preferred Units of $4.00 gives a Warrant strike of $6.00). The offering price per unit has been arbitrarily determined by the Company - See Risk Factors: Offering Price. ACCREDITED INVESTORS ONLY THESE ARE SPECULATIVE SECURITIES WHICH INVOLVE A HIGH DEGREE OF RISK. ONLY THOSE INVESTORS WHO CAN BEAR THE LOSS OF THEIR ENTIRE INVESTMENT SHOULD INVEST IN THESE UNITS. THE SECURITIES OFFERED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), THE SECURITIES LAWS OF THE STATE OF DELAWARE, OR UNDER THE SECURITIES LAWS OF ANY OTHER STATE OR JURISDICTION IN RELIANCE UPON THE EXEMPTIONS FROM REGISTRATION PROVIDED BY THE ACT AND REGULATION D RULE 506 PROMULGATED THEREUNDER, AND THE COMPARABLE EXEMPTIONS FROM REGISTRATION PROVIDED BY OTHER APPLICABLE SECURITIES LAWS. Sale Price Selling Commissions (2) Proceeds to Company (3) Per Unit $4.00 $0.36 $3.64 Minimum $2,000,000 $180,000 $1,820,000 Maximum $14,000,000 $1,260,000 $12,740,000 Offering Number: ______________ Name of Recipient: ______________

- 2. Confidential Private Placement Memorandum • Regulation D Rule 506(c) Page 2 Convertible Preferred Membership Units The Date of this Memorandum is October 15st , 2015 (1) The Company reserves the right to waive the 50,000 Unit minimum subscription for any investor. The Offering is not underwritten. The Units are offered on a “best efforts” basis by the Company through its officers and directors. The Company has set a minimum offering amount of 500,000 Units with minimum gross proceeds of $2,000,000 for this Offering. All proceeds from the sale of Units up to $2,000,000 will be deposited in an escrow account. Upon the sale of $2,000,000 of Units, all proceeds will be delivered directly to the Company’s corporate account and be available for use by the Company at its discretion. (2) Units may also be sold by FINRA member brokers or dealers who enter into a Participating Dealer Agreement with the Company, who will receive commissions of up to 9.00% of the price of the Units sold. The Company reserves the right to pay expenses related to this Offering from the proceeds of the Offering. See “PLAN OF PLACEMENT and USE OF PROCEEDS” section. (3) The Offering will terminate on the earliest of: (a) the date the Company, in its discretion, elects to terminate, or (b) the date upon which all Units have been sold, or (c) December 31, 2015, or such date as may be extended from time to time by the Company, but not later than 180 days thereafter (the “Offering Period”.)

- 3. Confidential Private Placement Memorandum • Regulation D Rule 506(c) Page 3 Convertible Preferred Membership Units IMPORTANT NOTICES You are urged to read this memorandum carefully. This memorandum is not all-inclusive and does not contain all the information that you may desire in investigating International Metals Trading, LLC. You must conduct and rely on your own evaluation of Company and the terms of this offering, including the merits and risks involved in making a decision to buy Company’s Preferred Units. Company will make available to you, prior to the sale of Preferred Units described in this memorandum, the opportunity to ask questions of, and receive answers from, Company’s management concerning the terms and conditions of this offering and to obtain any additional information (including information made available to other investors), to the extent Company possess it or can acquire it without unreasonable effort or expense, which may be necessary to verify the accuracy of the information in this memorandum. Company may require you to sign a confidentiality agreement if you wish to receive additional information that Company deem to be proprietary. You may mail questions, inquiries, and requests for information to 81 Prospect St, 8th Floor, Brooklyn, NY 11201 or call 866-804-2418; Executive Director – Ian Parker. You, and your representatives, if any, will be asked to acknowledge in the Subscription Agreement that you were given the opportunity to obtain additional information and that you did so or elected to waive the opportunity. No representations or warranties of any kind are intended nor should any be inferred with respect to the economic viability of this investment or with respect to any benefits, which may accrue to an investment in Company’s Preferred Units; Company and its directors, officers and employees, do not in any way represent, guarantee or warrant an economic gain or profit with regard to our business or that favorable income tax consequences will flow there from. Company does not in any way represent or warrant the advisability of buying Company’s Preferred Units. Any projections or other forward-looking statements or opinions contained in this memorandum constitute estimates by Company based upon historical track record of its management, but historical performance is not a guarantee of future returns. You should not consider the contents of this memorandum as legal, business or tax advice. Prior to making a decision to buy Company’s Preferred Units, you should carefully review and consider this memorandum and should consult your own attorneys, business advisors and tax advisors as to legal, business and tax related matters concerning this offering. RESTRICTIONS ON USE OF MEMORANDUM This memorandum is for review by the recipient only. The recipient, by accepting delivery of this memorandum, agrees to return this memorandum, all enclosed or attached documents and all other documents, if any, provided in connection with the offering to International Metals Trading, LLC if the recipient does not undertake to purchase any of the securities offered hereby. This memorandum is furnished for the sole use of the recipient, and for the sole purpose of providing information regarding the offer and sale of Company’s Preferred Units. Company has not authorized any other use of this information. Any distribution of this memorandum to a person other than representatives of the person or entity named on the cover page is unauthorized, and any reproduction of this memorandum or the divulgence of any of its contents, without prior written consent is prohibited. The delivery of this memorandum or other information does not imply that the memorandum or other information is correct as of any time subsequent to the date appearing on the cover of this memorandum. EXCLUSIVE NATURE OF CONFIDENTIAL PRIVATE PLACEMENT MEMORANDUM The delivery of this memorandum does not constitute an offer in any jurisdiction to any person to whom such offer would be unlawful in such jurisdiction. You should rely only on the information contained in this memorandum. The information contained in this memorandum supersedes any other information provided to potential investors. Company has not authorized any person to provide any information or to make any representations except to the extent contained in this memorandum. If any such representations are given or made, such information and representations must not be relied upon as having been authorized by International Metals Trading, LLC. This memorandum is not an offer to sell, nor is it seeking an offer to buy, Preferred Units

- 4. Confidential Private Placement Memorandum • Regulation D Rule 506(c) Page 4 Convertible Preferred Membership Units of Company in any state where the offer or sale is not permitted. The information in this memorandum is accurate as of the date on the front cover, but the information may have changed since that date. RESTRICTED SECURITIES Company has not registered this Series A Convertible Preferred Membership with the Securities and Exchange Commission. Company is offering the Series A Convertible Preferred Membership under exemptions from the registration requirements of the Act and applicable state laws. The Securities and Exchange Commission and state securities regulators have not approved or disapproved of the Series A Convertible Preferred Membership or determined if this memorandum is truthful or complete. It is illegal for any person to tell you otherwise. No public market currently exists for any of Company’s securities. The Series A Convertible Preferred Membership sold in connection with this memorandum will be “restricted securities” for purposes of federal and state securities laws, and each investor who purchases this Series A Convertible Preferred Membership must do so for the investor’s own account and investment. FORWARD-LOOKING STATEMENTS Certain statements in this memorandum constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements that address expectations or projections about the future, including statements about product development, market position, expected expenditures and financial results, are forward-looking statements. Some of the forward-looking statements may be identified by words like “expects,” “anticipates,” “plans,” “intends,” “projects,” “indicates,” and similar expressions. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. These statements are not guarantees of future performance and involve a number of risks, uncertainties and assumptions. Accordingly, actual results or performance of International Metals Trading, LLC may differ significantly, positively or negatively, from forward-looking statements made herein. Unanticipated events and circumstances are likely to occur. Factors that might cause such differences include, but are not limited to, those discussed under the heading “Risk Factors,” which investors should carefully consider. These factors include, but are not limited to, risks that Company’s products and services may not receive the level of market acceptance anticipated; anticipated funding may prove to be unavailable; intense competition in Company’s market may result in lower than anticipated revenues or higher than anticipated costs, and general economic conditions, such as the rate of employment, inflation, interest rates and the condition of the capital markets may change in a way that is not favorable to us. This list of factors is not exclusive. Company undertakes no obligation to update any forward- looking statements. REGULATORY AND TAX CONSIDERATIONS Additional Regulatory Considerations: Securities Act of 1933, Membership Units offered or sold within the United States will not be registered under the Securities Act in reliance upon the exemption from registration thereunder provided by Regulation D. Each Investor will be required to represent that it is an “accredited investor” as defined in Regulation D and that it is acquiring its Interest for investment and not for resale or distribution. Preferred Units may be resold only if they are registered under the Securities Act or an exemption from registration is available. In addition, Interest may not be assigned or transferred without the consent of the Company. Investment Company Act of 1940: The number of beneficial owners of Preferred Units is limited to 99 or fewer in order for the Company to qualify for the exemption from registration under Section 3(c)(1) of the Investment Company Act of 1940, as amended. With respect to determination of the number of such beneficial

- 5. Confidential Private Placement Memorandum • Regulation D Rule 506(c) Page 5 Convertible Preferred Membership Units owners, the Company obtains appropriate representations and undertakings from each Investor, in order to assure that Company meets the conditions of the exemption on an ongoing basis. State and Local Taxes: Prospective Investors should consult their own tax advisors concerning the state and local tax consequences of investing in Company. ADDITIONAL INFORMATION AVAILABLE UPON REQUEST The Financial Projection within this memorandum and the corresponding Subscription Agreement supplement this memorandum. Company will make certain information available to investors upon request including Company’s Articles of Operation, Company’s Operating Agreement and other corporate records.

- 6. Confidential Private Placement Memorandum • Regulation D Rule 506(c) Page 6 Convertible Preferred Membership Units I. JURISDICTIONAL (NASAA) LEGENDS FOR RESIDENTS OF ALL STATES: THE PRESENCE OF A LEGEND FOR ANY GIVEN STATE REFLECTS ONLY THAT A LEGEND MAY BE REQUIRED BY THAT STATE AND SHOULD NOT BE CONSTRUED TO MEAN AN OFFER OR SALE MAY BE MADE IN A PARTICULAR STATE. IF YOU ARE UNCERTAIN AS TO WHETHER OR NOT OFFERS OR SALES MAY BE LAWFULLY MADE IN ANY GIVEN STATE, YOU ARE HEREBY ADVISED TO CONTACT THE COMPANY. THE SECURITIES DESCRIBED IN THIS MEMORANDUM HAVE NOT BEEN REGISTERED UNDER ANY STATE SECURITIES LAWS (COMMONLY CALLED "BLUE SKY" LAWS) THESE SECURITIES MUST BE ACQUIRED FOR INVESTMENT PURPOSES ONLY AND MAY NOT BE SOLD OR TRANSFERRED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION OF SUCH SECURITIES UNDER SUCH LAWS, OR AN OPINION OF COUNSEL ACCEPTABLE TO THE COMPANY THAT SUCH REGISTRATION IS NOT REQUIRED. THE PRESENCE OF A LEGEND FOR ANY GIVEN STATE REFLECTS ONLY THAT A LEGEND MAY BE REQUIRED BY THE STATE AND SHOULD NOT BE CONSTRUED TO MEAN AN OFFER OF SALE MAY BE MADE IN ANY PARTICULAR STATE. 1. NOTICE TO ALABAMA RESIDENTS ONLY: THESE SECURITIES ARE OFFERED PURSUANT TO A CLAIM OF EXEMPTION UNDER THE ALABAMA SECURITIES ACT. A REGISTRATION STATEMENT RELATING TO THESE SECURITIES HAS NOT BEEN FILED WITH THE ALABAMA SECURITIES COMMISSION. THE COMMISSION DOES NOT RECOMMEND OR ENDORSE THE PURCHASE OF ANY SECURITIES, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF THIS PRIVATE PLACEMENT MEMORANDUM. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. 2. NOTICE TO ALASKA RESIDENTS ONLY: THE SECURITIES OFFERED HAVE NOT BEEN REGISTERED WITH THE ADMINISTRATOR OF SECURITIES OF THE STATE OF ALASKA UNDER PROVISIONS OF 3 AAC 08.500-3 AAC 08.504. THE INVESTOR IS ADVISED THAT THE ADMINISTRATOR HAS MADE ONLY A CURSORY REVIEW OF THE REGISTRATION STATEMENT AND HAS NOT REVIEWED THIS DOCUMENT SINCE THE DOCUMENT IS NOT REQUIRED TO BE FILED WITH THE ADMINISTRATOR. THE FACT OF REGISTRATION DOES NOT MEAN THAT THE ADMINISTRATOR HAS PASSED IN ANY WAY UPON THE MERITS, RECOMMENDED, OR APPROVED THE SECURITIES. ANY REPRESENTATION TO THE CONTRARY IS A VIOLATION OF 45.55.170. THE INVESTOR MUST RELY ON THE INVESTOR'S OWN EXAMINATION OF THE PERSON OR ENTITY CREATING THE SECURITIES AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED IN MAKING AN INVESTMENT DECISION ON THESE SECURITIES. 3. NOTICE TO ARIZONA RESIDENTS ONLY: THESE SECURITIES HAVE NOT BEEN REGISTERED UNDER THE ARIZONA SECURITIES ACT IN RELIANCE UPON AN EXEMPTION FROM REGISTRATION PURSUANT TO A.R.S. SECTION 44-1844 (1) AND THEREFORE CANNOT BE RESOLD UNLESS THEY ARE ALSO REGISTERED OR UNLESS AN EXEMPTION FROM REGISTRATION IS AVAILABLE. 4. NOTICE TO ARKANSAS RESIDENTS ONLY: THESE SECURITIES ARE OFFERED IN RELIANCE UPON CLAIMS OF EXEMPTION UNDER THE ARKANSAS SECURITIES ACT AND SECTION 4(2) OF THE SECURITIES ACT OF 1933. A REGISTRATION STATEMENT RELATING TO THESE SECURITIES HAS NOT BEEN FILED WITH THE ARKANSAS SECURITIES DEPARTMENT OR WITH THE SECURITIES AND EXCHANGE COMMISSION. NEITHER THE DEPARTMENT NOR THE COMMISSION HAS PASSED UPON THE VALUE OF THESE SECURITIES, MADE ANY

- 7. Confidential Private Placement Memorandum • Regulation D Rule 506(c) Page 7 Convertible Preferred Membership Units RECOMMENDATIONS AS TO THEIR PURCHASE, APPROVED OR DISAPPROVED THIS OFFERING OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS MEMORANDUM. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL. 5. FOR DELAWARE RESIDENTS ONLY: THE SALE OF THE SECURITIES WHICH ARE THE SUBJECT OF THIS OFFERING HAS NOT BEEN QUALIFIED WITH COMMISSIONER OF CORPORATIONS OF THE STATE OF DELAWARE AND THE ISSUANCE OF SUCH SECURITIES OR PAYMENT OR RECEIPT OF ANY PART OF THE CONSIDERATION THEREFORE PRIOR TO SUCH QUALIFICATIONS IS UNLAWFUL, UNLESS THE SALE OF SECURITIES IS EXEMPTED FROM QUALIFICATION BY SECTION 25100, 25102, OR 25104 OF THE DELAWARE CORPORATIONS CODE. THE RIGHTS OF ALL PARTIES TO THIS OFFERING ARE EXPRESSLY CONDITION UPON SUCH QUALIFICATIONS BEING OBTAINED, UNLESS THE SALE IS SO EXEMPT. 6. FOR COLORADO RESIDENTS ONLY: THE SECURITIES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR THE COLORADO SECURITIES ACT OF 1991 BY REASON OF SPECIFIC EXEMPTIONS THEREUNDER RELATING TO THE LIMITED AVAILABILITY OF THE OFFERING. THESE SECURITIES CANNOT BE RESOLD, TRANSFERRED OR OTHERWISE DISPOSED OF TO ANY PERSON OR ENTITY UNLESS SUBSEQUENTLY REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR THE COLORADO SECURITIES ACT OF 1991, IF SUCH REGISTRATION IS REQUIRED. 7. NOTICE TO CONNECTICUT RESIDENTS ONLY: SHARES ACQUIRED BY CONNECTICUT RESIDENTS ARE BEING SOLD AS A TRANSACTION EXEMPT UNDER SECTION 36-409(b)(9)(A) OF THE CONNECTICUT, UNIFORM SECURITIES ACT. THE SHARES HAVE NOT BEEN REGISTERED UNDER SAID ACT IN THE STATE OF CONNECTICUT. ALL INVESTORS SHOULD BE AWARE THAT THERE ARE CERTAIN RESTRICTIONS AS TO THE TRANSFERABILITY OF THE SHARES. 8. NOTICE TO DELAWARE RESIDENTS ONLY: IF YOU ARE A DELAWARE RESIDENT, YOU ARE HEREBY ADVISED THAT THESE SECURITIES ARE BEING OFFERED IN A TRANSACTION EXEMPT FROM THE REGISTRATION REQUIREMENTS OF THE DELAWARE SECURITIES ACT. THE SECURITIES CANNOT BE SOLD OR TRANSFERRED EXCEPT IN A TRANSACTION WHICH IS EXEMPT UNDER THE ACT OR PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE ACT OR IN A TRANSACTION WHICH IS OTHERWISE IN COMPLIANCE WITH THE ACT. 9. NOTICE TO DISTRICT OF COLUMBIA RESIDENTS ONLY: THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES BUREAU OF THE DISTRICT OF COLUMBIA NOR HAS THE COMMISSIONER PASSED UPON THE ACCURACY OR ADEQUACY OF THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL. 10. NOTICE TO FLORIDA RESIDENTS ONLY: THE SHARES DESCRIBED HEREIN HAVE NOT BEEN REGISTERED WITH THE FLORIDA DIVISION OF SECURITIES AND INVESTOR PROTECTION UNDER THE FLORIDA SECURITIES ACT. THE SHARES REFERRED TO HEREIN WILL BE SOLD TO, AND ACQUIRED BY THE HOLDER IN A TRANSACTION EXEMPT UNDER SECTION 517.061 OF SAID ACT. THE SHARES HAVE NOT BEEN REGISTERED UNDER SAID ACT IN THE STATE OF FLORIDA. IN ADDITION, ALL OFFEREES WHO ARE FLORIDA RESIDENTS SHOULD BE AWARE THAT SECTION 517.061(11)(a)(5) OF THE ACT PROVIDES, IN RELEVANT PART, AS FOLLOWS: "WHEN SALES ARE MADE TO FIVE OR MORE PERSONS IN [FLORIDA], ANY SALE IN [FLORIDA] MADE PURSUANT TO [THIS SECTION] IS VOIDABLE BY THE PURCHASER IN SUCH SALE EITHER WITHIN 3 DAYS AFTER THE FIRST TENDER OF CONSIDERATION IS MADE BY THE PURCHASER TO THE ISSUER, AN AGENT OF THE ISSUER OR AN ESCROW AGENT OR WITHIN 3 DAYS AFTER THE AVAILABILITY OF THAT PRIVILEGE IS COMMUNICATED TO SUCH PURCHASER, WHICHEVER OCCURS LATER." THE AVAILABILITY OF THE PRIVILEGE TO VOID SALES PURSUANT TO SECTION 517.061(11) IS HEREBY COMMUNICATED TO EACH FLORIDA OFFEREE. EACH PERSON ENTITLED TO EXERCISE THE PRIVILEGE TO AVOID SALES GRANTED BY SECTION 517.061 (11) (A)(5) AND WHO WISHES TO EXERCISE SUCH RIGHT, MUST, WITHIN 3 DAYS AFTER THE TENDER OF ANY AMOUNT TO THE COMPANY OR TO ANY AGENT OF THE COMPANY (INCLUDING THE SELLING AGENT OR ANY OTHER DEALER ACTING ON BEHALF OF THE PARTNERSHIP OR ANY SALESMAN OF SUCH

- 8. Confidential Private Placement Memorandum • Regulation D Rule 506(c) Page 8 Convertible Preferred Membership Units DEALER) OR AN ESCROW AGENT CAUSE A WRITTEN NOTICE OR TELEGRAM TO BE SENT TO THE COMPANY AT THE ADDRESS PROVIDED IN THIS CONFIDENTIAL EXECUTIVE SUMMARY. SUCH LETTER OR TELEGRAM MUST BE SENT AND, IF POSTMARKED, POSTMARKED ON OR PRIOR TO THE END OF THE AFOREMENTIONED THIRD DAY. IF A PERSON IS SENDING A LETTER, IT IS PRUDENT TO SEND SUCH LETTER BY CERTIFIED MAIL, RETURN RECEIPT REQUESTED, TO ASSURE THAT IT IS RECEIVED AND ALSO TO EVIDENCE THE TIME IT WAS MAILED. SHOULD A PERSON MAKE THIS REQUEST ORALLY, HE MUST ASK FOR WRITTEN CONFIRMATION THAT HIS REQUEST HAS BEEN RECEIVED. 11. NOTICE TO GEORGIA RESIDENTS ONLY: THESE SECURITIES ARE OFFERED IN A TRANSACTION EXEMPT FROM THE REGISTRATION REQUIREMENTS OF THE GEORGIA SECURITIES ACT PURSUANT TO REGULATION 590-4-5-04 AND -01. THE SECURITIES CANNOT BE SOLD OR TRANSFERRED EXCEPT IN A TRANSACTION WHICH IS EXEMPT UNDER THE ACT OR PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE ACT OR IN A TRANSACTION WHICH IS OTHERWISE IN COMPLIANCE WITH THE ACT. 12. NOTICE TO HAWAII RESIDENTS ONLY: NEITHER THIS PROSPECTUS NOR THE SECURITIES DESCRIBED HEREIN BEEN APPROVED OR DISAPPROVED BY THE COMMISSIONER OF SECURITIES OF THE STATE OF HAWAII NOR HAS THE COMMISSIONER PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. 13. NOTICE TO IDAHO RESIDENTS ONLY: THESE SECURITIES EVIDENCED HEREBY HAVE NOT BEEN REGISTERED UNDER THE IDAHO SECURITIES ACT IN RELIANCE UPON EXEMPTION FROM REGISTRATION PURSUANT TO SECTION 30-14-203 OR 302(c) THEREOF AND MAY NOT BE SOLD, TRANSFERRED, PLEDGED OR HYPOTHECATED EXCEPT IN A TRANSACTION WHICH IS EXEMPT UNDER SAID ACT OR PURSUANT TO AN EFFECTIVE REGISTRATION UNDER SAID ACT. 14. NOTICE TO ILLINOIS RESIDENTS: THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECRETARY OF THE STATE OF ILLINOIS NOR HAS THE STATE OF ILLINOIS PASSED UPON THE ACCURACY OR ADEQUACY OF THE PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL. 15. NOTICE TO INDIANA RESIDENTS ONLY: THESE SECURITIES ARE OFFERED PURSUANT TO A CLAIM OF EXEMPTION UNDER SECTION 23-2-1-2 OF THE INDIANA SECURITIES LAW AND HAVE NOT BEEN REGISTERED UNDER SECTION 23-2-1-3. THEY CANNOT THEREFORE BE RESOLD UNLESS THEY ARE REGISTERED UNDER SAID LAW OR UNLESS AN EXEMPTION FORM REGISTRATION IS AVAILABLE. A CLAIM OF EXEMPTION UNDER SAID LAW HAS BEEN FILED, AND IF SUCH EXEMPTION IS NOT DISALLOWED SALES OF THESE SECURITIES MAY BE MADE. HOWEVER, UNTIL SUCH EXEMPTION IS GRANTED, ANY OFFER MADE PURSUANT HERETO IS PRELIMINARY AND SUBJECT TO MATERIAL CHANGE. 16. NOTICE TO IOWA RESIDENTS ONLY: IN MAKING AN INVESTMENT DECISION INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE PERSON OR ENTITY CREATING THE SECURITIES AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED. THESE SECURITIES HAVE NOT BEEN RECOMMENDED; THE FOREGOING AUTHORITIES HAVE NOT CONFIRMED THE ACCURACY OR DETERMINED THE ADEQUACY OF THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. THESE SECURITIES ARE SUBJECT TO RESTRICTIONS ON TRANSFERABILITY AND RESALE AND MAY NOT BE TRANSFERRED OR RESOLD EXCEPT AS PERMITTED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, AND THE APPLICABLE STATE SECURITIES LAWS, PURSUANT TO REGISTRATION OR EXEMPTION THEREFROM. INVESTORS SHOULD BE AWARE THAT THEY WILL BE REQUIRED TO BEAR THE FINANCIAL RISKS OF THIS INVESTMENT FOR AN INDEFINITE PERIOD OF TIME. 17. NOTICE TO KANSAS RESIDENTS ONLY: IF AN INVESTOR ACCEPTS AN OFFER TO PURCHASE ANY OF THE SECURITIES, THE INVESTOR IS HEREBY ADVISED THE SECURITIES WILL BE SOLD TO AND ACQUIRED BY IT/HIM/HER IN A TRANSACTION EXEMPT FROM REGISTRATION UNDER SECTION 81-5-6 OF THE KANSAS SECURITIES ACT AND MAY NOT BE RE-

- 9. Confidential Private Placement Memorandum • Regulation D Rule 506(c) Page 9 Convertible Preferred Membership Units OFFERED FOR SALE, TRANSFERRED, OR RESOLD EXCEPT IN COMPLIANCE WITH SUCH ACT AND APPLICABLE RULES PROMULGATED THEREUNDER. 18. NOTICE TO KENTUCKY RESIDENTS ONLY: IF AN INVESTOR ACCEPTS AN OFFER TO PURCHASE ANY OF THE SECURITIES, THE INVESTOR IS HEREBY ADVISED THE SECURITIES WILL BE SOLD TO AND ACQUIRED BY IT/HIM/HER IN A TRANSACTION EXEMPT FROM REGISTRATION UNDER RULE 808 OF THE KENTUCKY SECURITIES ACT AND MAY NOT BE RE- OFFERED FOR SALE, TRANSFERRED, OR RESOLD EXCEPT IN COMPLIANCE WITH SUCH ACT AND APPLICABLE RULES PROMULGATED THEREUNDER. 19. NOTICE TO LOUISIANA RESIDENTS ONLY: IF AN INVESTOR ACCEPTS AN OFFER TO PURCHASE ANY OF THE SECURITIES, THE INVESTOR IS HEREBY ADVISED THE SECURITIES WILL BE SOLD TO AND ACQUIRED BY IT/HIM/HER IN A TRANSACTION EXEMPT FROM REGISTRATION UNDER RULE 1 OF THE LOUISIANA SECURITIES LAW AND MAY NOT BE RE- OFFERED FOR SALE, TRANSFERRED, OR RESOLD EXCEPT IN COMPLIANCE WITH SUCH ACT AND APPLICABLE RULES PROMULGATED THEREUNDER. 20. NOTICE TO MAINE RESIDENTS ONLY: THE ISSUER IS REQUIRED TO MAKE A REASONABLE FINDING THAT THE SECURITIES OFFERED ARE A SUITABLE INVESTMENT FOR THE PURCHASER AND THAT THE PURCHASER IS FINANCIALLY ABLE TO BEAR THE RISK OF LOSING THE ENTIRE AMOUNT INVESTED. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION UNDER §16202(15) OF THE MAINE UNIFORM SECURITIES ACT AND ARE NOT REGISTERED WITH THE SECURITIES ADMINISTRATOR OF THE STATE OF MAINE. THE SECURITIES OFFERED FOR SALE MAY BE RESTRICTED SECURITIES AND THE HOLDER MAY NOT BE ABLE TO RESELL THE SECURITIES UNLESS: (1) THE SECURITIES ARE REGISTERED UNDER STATE AND FEDERAL SECURITIES LAWS, OR (2) AN EXEMPTION IS AVAILABLE UNDER THOSE LAWS. 21. NOTICE TO MARYLAND RESIDENTS ONLY: IF YOU ARE A MARYLAND RESIDENT AND YOU ACCEPT AN OFFER TO PURCHASE THESE SECURITIES PURSUANT TO THIS MEMORANDUM, YOU ARE HEREBY ADVISED THAT THESE SECURITIES ARE BEING SOLD AS A TRANSACTION EXEMPT UNDER SECTION 11-602(9) OF THE MARYLAND SECURITIES ACT. THE SHARES HAVE NOT BEEN REGISTERED UNDER SAID ACT IN THE STATE OF MARYLAND. ALL INVESTORS SHOULD BE AWARE THAT THERE ARE CERTAIN RESTRICTIONS AS TO THE TRANSFERABILITY OF THE SHARES. 22. NOTICE TO MASSACHUSETTS RESIDENTS ONLY: THESE SECURITIES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR THE MASSACHUSETTS UNIFORM SECURITIES ACT, BY REASON OF SPECIFIC EXEMPTIONS THEREUNDER RELATING TO THE LIMITED AVAILABILITY OF THIS OFFERING. THESE SECURITIES CANNOT BE SOLD, TRANSFERRED, OR OTHERWISE DISPOSED OF TO ANY PERSON OR ENTITY UNLESS THEY ARE SUBSEQUENTLY REGISTERED OR AN EXEMPTION FROM REGISTRATION IS AVAILABLE. 23. NOTICE TO MICHIGAN RESIDENTS ONLY: THESE SECURITIES HAVE NOT BEEN REGISTERED UNDER SECTION 451.701 OF THE MICHIGAN UNIFORM SECURITIES ACT (THE ACT) AND MAY BE TRANSFERRED OR RESOLD BY RESIDENTS OF MICHIGAN ONLY IF REGISTERED PURSUANT TO THE PROVISIONS OF THE ACT, OR IF AN EXEMPTION FROM REGISTRATION IS AVAILABLE. THE INVESTMENT IS SUITABLE IF IT DOES NOT EXCEED 10% OF THE INVESTOR'S NET WORTH. 24. NOTICE TO MINNESOTA RESIDENTS ONLY: THESE SECURITIES BEING OFFERED HEREBY HAVE NOT BEEN REGISTERED UNDER CHAPTER 80A OF THE MINNESOTA SECURITIES LAWS AND MAY NOT BE SOLD, TRANSFERRED, OR OTHERWISE DISPOSED OF EXCEPT PURSUANT TO REGISTRATION, OR AN EXEMPTION THEREFROM.

- 10. Confidential Private Placement Memorandum • Regulation D Rule 506(c) Page 10 Convertible Preferred Membership Units 25. NOTICE TO MISSISSIPPI RESIDENTS ONLY: THE SHARES ARE OFFERED PURSUANT TO A CLAIM OF EXEMPTION UNDER THE MISSISSIPPI SECURITIES ACT. A REGISTRATION STATEMENT RELATING TO THESE SECURITIES HAS NOT BEEN FILED WITH THE MISSISSIPPI SECRETARY OF STATE OR WITH THE SECURITIES AND EXCHANGE COMMISSION. NEITHER THE SECRETARY OF STATE NOR THE COMMISSION HAS PASSED UPON THE VALUE OF THESE SECURITIES, OR APPROVED OR DISAPPROVED THIS OFFERING. THE SECRETARY OF STATE DOES NOT RECOMMEND THE PURCHASE OF THESE OR ANY OTHER SECURITIES. EACH PURCHASER OF THE SECURITIES MUST MEET CERTAIN SUITABILITY STANDARDS AND MUST BE ABLE TO BEAR AN ENTIRE LOSS OF THIS INVESTMENT. THE SECURITIES MAY NOT BE TRANSFERRED FOR A PERIOD OF ONE (1) YEAR EXCEPT IN A TRANSACTION WHICH IS EXEMPT UNDER THE MISSISSIPPI SECURITIES ACT OR IN A TRANSACTION IN COMPLIANCE WITH THE MISSISSIPPI SECURITIES ACT. 26. FOR MISSOURI RESIDENTS ONLY: THE SECURITIES OFFERED HEREIN WILL BE SOLD TO, AND ACQUIRED BY, THE PURCHASER IN A TRANSACTION EXEMPT UNDER SECTION 4.G OF THE MISSOURI SECURITIES LAW OF 1953, AS AMENDED. THESE SECURITIES HAVE NOT BEEN REGISTERED UNDER SAID ACT IN THE STATE OF MISSOURI. UNLESS THE SECURITIES ARE SO REGISTERED, THEY MAY NOT BE OFFERED FOR SALE OR RESOLD IN THE STATE OF MISSOURI, EXCEPT AS A SECURITY, OR IN A TRANSACTION EXEMPT UNDER SAID ACT. 27. NOTICE TO MONTANA RESIDENTS ONLY: IN ADDITION TO THE INVESTOR SUITABILITY STANDARDS THAT ARE OTHERWISE APPLICABLE, ANY INVESTOR WHO IS A MONTANA RESIDENT MUST HAVE A NET WORTH (EXCLUSIVE OF HOME, FURNISHINGS AND AUTOMOBILES) IN EXCESS OF FIVE (5) TIMES THE AGGREGATE AMOUNT INVESTED BY SUCH INVESTOR IN THE SHARES. 28. NOTICE TO NEBRASKA RESIDENTS ONLY: IF AN INVESTOR ACCEPTS AN OFFER TO PURCHASE ANY OF THE SECURITIES, THE INVESTOR IS HEREBY ADVISED THE SECURITIES WILL BE SOLD TO AND ACQUIRED BY IT/HIM/HER IN A TRANSACTION EXEMPT FROM REGISTRATION UNDER CHAPTER 15 OF THE NEBRASKA SECURITIES LAW AND MAY NOT BE RE-OFFERED FOR SALE, TRANSFERRED, OR RESOLD EXCEPT IN COMPLIANCE WITH SUCH ACT AND APPLICABLE RULES PROMULGATED THEREUNDER. 29. NOTICE TO NEVADA RESIDENTS ONLY: IF ANY INVESTOR ACCEPTS ANY OFFER TO PURCHASE THE SECURITIES, THE INVESTOR IS HEREBY ADVISED THE SECURITIES WILL BE SOLD TO AND ACQUIRED BY IT/HIM/HER IN A TRANSACTION EXEMPT FROM REGISTRATION UNDER SECTION 49:3-60(b) OF THE NEVADA SECURITIES LAW. THE INVESTOR IS HEREBY ADVISED THAT THE ATTORNEY GENERAL OF THE STATE OF NEVADA HAS NOT PASSED ON OR ENDORSED THE MERITS OF THIS OFFERING AND THE FILING OF THE OFFERING WITH THE BUREAU OF SECURITIES DOES NOT CONSTITUTE APPROVAL OF THE ISSUE, OR SALE THEREOF, BY THE BUREAU OF SECURITIES OR THE DEPARTMENT OF LAW AND PUBLIC SAFETY OF THE STATE OF NEVADA. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL. NEVADA ALLOWS THE SALE OF SECURITIES TO 25 OR FEWER PURCHASERS IN THE STATE WITHOUT REGISTRATION. HOWEVER, CERTAIN CONDITIONS APPLY, I.E., COMMISSIONS ARE LIMITED TO LICENSED BROKER-DEALERS. THIS EXEMPTION IS GENERALLY USED WHERE THE PROSPECTIVE INVESTOR IS ALREADY KNOWN AND HAS A PRE-EXISTING RELATIONSHIP WITH THE COMPANY. (SEE NRS 90.530.11.) 30. NOTICE TO NEW HAMPSHIRE RESIDENTS ONLY: NEITHER THE FACT THAT A REGISTRATION STATEMENT OR AN APPLICATION FOR A LICENSE UNDER THIS CHAPTER HAS BEEN FILED WITH THE STATE OF NEW HAMPSHIRE NOR THE FACT THAT A SECURITY IS EFFECTIVELY REGISTERED OR A PERSON IS LICENSED IN THE STATE OF NEW HAMPSHIRE CONSTITUTES A FINDING BY THE SECRETARY OF STATE THAT ANY DOCUMENT FILED UNDER RSA 421-B IS TRUE, COMPLETE AND NOT MISLEADING. NEITHER ANY SUCH FACT NOR THE FACT THAT AN EXEMPTION OR EXCEPTION IS AVAILABLE FOR A SECURITY OR A TRANSACTION MEANS THAT THE SECRETARY OF STATE HAS PASSED IN ANY WAY UPON THE MERITS OR QUALIFICATIONS OF, OR RECOMMENDED OR GIVEN APPROVAL TO, ANY PERSON, SECURITY, OR TRANSACTION. IT IS UNLAWFUL TO MAKE, OR CAUSE TO BE MADE, TO ANY PROSPECTIVE PURCHASER, CUSTOMER, OR CLIENT ANY REPRESENTATION INCONSISTENT

- 11. Confidential Private Placement Memorandum • Regulation D Rule 506(c) Page 11 Convertible Preferred Membership Units WITH THE PROVISIONS OF THIS PARAGRAPH. 31. NOTICE TO NEW JERSEY RESIDENTS ONLY: IF YOU ARE A NEW JERSEY RESIDENT AND YOU ACCEPT AN OFFER TO PURCHASE THESE SECURITIES PURSUANT TO THIS MEMORANDUM, YOU ARE HEREBY ADVISED THAT THIS MEMORANDUM HAS NOT BEEN FILED WITH OR REVIEWED BY THE ATTORNEY GENERAL OF THE STATE OF NEW JERSEY PRIOR TO ITS ISSUANCE AND USE. THE ATTORNEY GENERAL OF THE STATE OF NEW JERSEY HAS NOT PASSED ON OR ENDORSED THE MERITS OF THIS OFFERING. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL. 32. NOTICE TO NEW MEXICO RESIDENTS ONLY: THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES DIVISION OF THE NEW MEXICO DEPARTMENT OF BANKING NOR HAS THE SECURITIES DIVISION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PRIVATE PLACEMENT MEMORANDUM. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. 33. NOTICE TO NEW YORK RESIDENTS ONLY: THIS DOCUMENT HAS NOT BEEN REVIEWED BY THE ATTORNEY GENERAL OF THE STATE OF NEW YORK PRIOR TO ITS ISSUANCE AND USE. THE ATTORNEY GENERAL OF THE STATE OF NEW YORK HAS NOT PASSED ON OR ENDORSED THE MERITS OF THIS OFFERING. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL. THE COMPANY HAS TAKEN NO STEPS TO CREATE AN AFTER MARKET FOR THE SHARES OFFERED HEREIN AND HAS MADE NO ARRANGEMENTS WITH BROKERS OF OTHERS TO TRADE OR MAKE A MARKET IN THE SHARES. AT SOME TIME IN THE FUTURE, THE COMPANY MAY ATTEMPT TO ARRANGE FOR INTERESTED BROKERS TO TRADE OR MAKE A MARKET IN THE SECURITIES AND TO QUOTE THE SAME IN A PUBLISHED QUOTATION MEDIUM, HOWEVER, NO SUCH ARRANGEMENTS HAVE BEEN MADE AND THERE IS NO ASSURANCE THAT ANY BROKERS WILL EVER HAVE SUCH AN INTEREST IN THE SECURITIES OF THE COMPANY OR THAT THERE WILL EVER BE A MARKET THEREFORE. 34. NOTICE TO NORTH CAROLINA RESIDENTS ONLY: IN MAKING AN INVESTMENT DECISION, INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE PERSON OR ENTITY CREATING THE SECURITIES AND THE TERMS OF THE OFFERING, INCLUDING MERITS AND RISKS INVOLVED. THESE SECURITIES HAVE NOT BEEN RECOMMENDED BY ANY FEDERAL OR STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY. FURTHERMORE, THE FORGOING AUTHORITIES HAVE NOT CONFIRMED ACCURACY OR DETERMINED ADEQUACY OF THIS DOCUMENT. REPRESENTATION TO THE CONTRARY IS UNLAWFUL. THESE SECURITIES ARE SUBJECT TO RESTRICTIONS ON TRANSFERABILITY AND RESALE AND MAY NOT BE TRANSFERRED OR RESOLD EXCEPT AS PERMITTED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, AND APPLICABLE STATE SECURITIES LAWS, PURSUANT TO REGISTRATION OR EXEMPTION THEREFROM. INVESTORS SHOULD BE AWARE THAT THEY WILL BE REQUIRED TO BEAR THE FINANCIAL RISKS OF THIS INVESTMENT FOR AN INDEFINITE PERIOD OF TIME. 35. NOTICE TO NORTH DAKOTA RESIDENTS ONLY: THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES COMMISSIONER OF THE STATE OF NORTH DAKOTA NOR HAS THE COMMISSIONER PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. 36. NOTICE TO OHIO RESIDENTS ONLY: IF AN INVESTOR ACCEPTS AN OFFER TO PURCHASE ANY OF THE SECURITIES, THE INVESTOR IS HEREBY ADVISED THE SECURITIES WILL BE SOLD TO AND ACQUIRED BY IT/HIM/HER IN A TRANSACTION EXEMPT FROM REGISTRATION UNDER SECTION 107.03(2) OF THE OHIO SECURITIES LAW AND MAY NOT BE RE-OFFERED FOR SALE, TRANSFERRED, OR RESOLD EXCEPT IN COMPLIANCE WITH SUCH ACT AND APPLICABLE RULES PROMULGATED THEREUNDER. 37. NOTICE TO OKLAHOMA RESIDENTS ONLY: THESE SECURITIES ARE OFFERED FOR SALE IN THE STATE OF OKLAHOMA IN RELIANCE UPON AN EXEMPTION FROM REGISTRATION FOR PRIVATE OFFERINGS. ALTHOUGH A PRIOR FILING OF THIS MEMORANDUM AND THE INFORMATION HAS BEEN MADE WITH THE OKLAHOMA SECURITIES COMMISSION, SUCH FILING IS PERMISSIVE ONLY AND DOES NOT CONSTITUTE AN APPROVAL, RECOMMENDATION

- 12. Confidential Private Placement Memorandum • Regulation D Rule 506(c) Page 12 Convertible Preferred Membership Units OR ENDORSEMENT, AND IN NO SENSE IS TO BE REPRESENTED AS AN INDICATION OF THE INVESTMENT MERIT OF SUCH SECURITIES. ANY SUCH REPRESENTATION IS UNLAWFUL. 38. NOTICE TO OREGON RESIDENTS ONLY: THE SECURITIES OFFERED HAVE BEEN REGISTERED WITH THE CORPORATION COMMISSION OF THE STATE OF OREGON UNDER PROVISIONS OF OAR 815 DIVISION 36. THE INVESTOR IS ADVISED THAT THE COMMISSIONER HAS MADE ONLY A CURSORY REVIEW OF THE REGISTRATION STATEMENT AND HAS NOT REVIEWED THIS DOCUMENT SINCE THE DOCUMENT IS NOT REQUIRED TO BE FILED WITH THE COMMISSIONER. THE INVESTOR MUST RELY ON THE INVESTOR'S OWN EXAMINATION OF THE COMPANY CREATING THE SECURITIES, AND THE TERMS OF THE OFFERING INCLUDING THE MERITS AND RISKS INVOLVED IN MAKING AN INVESTMENT DECISION ON THESE SECURITIES. 39. NOTICE TO PENNSYLVANIA RESIDENTS ONLY: EACH PERSON WHO ACCEPTS AN OFFER TO PURCHASE SECURITIES EXEMPTED FROM REGISTRATION BY SECTION 203(d), DIRECTLY FROM THE ISSUER OR AFFILIATE OF THIS ISSUER, SHALL HAVE THE RIGHT TO WITHDRAW HIS ACCEPTANCE WITHOUT INCURRING ANY LIABILITY TO THE SELLER, UNDERWRITER (IF ANY) OR ANY OTHER PERSON WITHIN TWO (2) BUSINESS DAYS FROM THE DATE OF RECEIPT BY THE ISSUER OF HIS WRITTEN BINDING CONTRACT OF PURCHASE OR, IN THE CASE OF A TRANSACTION IN WHICH THERE IS NO BINDING CONTRACT OF PURCHASE, WITHIN TWO (2) BUSINESS DAYS AFTER HE MAKES THE INITIAL PAYMENT FOR THE SECURITIES BEING OFFERED. IF YOU HAVE ACCEPTED AN OFFER TO PURCHASE THESE SECURITIES MADE PURSUANT TO A PROSPECTUS WHICH CONTAINS A NOTICE EXPLAINING YOUR RIGHT TO WITHDRAW YOUR ACCEPTANCE PURSUANT TO SECTION 207(m) OF THE PENNSYLVANIA SECURITIES ACT OF 1972 (70 PS § 1-207(m), YOU MAY ELECT, WITHIN TWO (2) BUSINESS DAYS AFTER THE FIRST TIME YOU HAVE RECEIVED THIS NOTICE AND A PROSPECTUS TO WITHDRAW FROM YOUR PURCHASE AGREEMENT AND RECEIVE A FULL REFUND OF ALL MONEYS PAID BY YOU. YOUR WITHDRAWAL WILL BE WITHOUT ANY FURTHER LIABILITY TO ANY PERSON. TO ACCOMPLISH THIS WITHDRAWAL, YOU NEED ONLY SEND A LETTER OR TELEGRAM TO THE ISSUER (OR UNDERWRITER IF ONE IS LISTED ON THE FRONT PAGE OF THE PROSPECTUS) INDICATING YOUR INTENTION TO WITHDRAW. SUCH LETTER OR TELEGRAM SHOULD BE SENT AND POSTMARKED PRIOR TO THE END OF THE AFOREMENTIONED SECOND BUSINESS DAY. IF YOU ARE SENDING A LETTER, IT IS PRUDENT TO SEND IT BY CERTIFIED MAIL, RETURN RECEIPT REQUESTED, TO ENSGTI THAT IT IS RECEIVED AND ALSO EVIDENCE THE TIME WHEN IT WAS MAILED. SHOULD YOU MAKE THIS REQUEST ORALLY, YOU SHOULD ASK WRITTEN CONFIRMATION THAT YOUR REQUEST HAS BEEN RECEIVED. NO SALE OF THE SECURITIES WILL BE MADE TO RESIDENTS OF THE STATE OF PENNSYLVANIA WHO ARE NON-ACCREDITED INVESTORS. EACH PENNSYLVANIA RESIDENT MUST AGREE NOT TO SELL THESE SECURITIES FOR A PERIOD OF TWELVE (12) MONTHS AFTER THE DATE OF PURCHASE, EXCEPT IN ACCORDANCE WITH WAIVERS ESTABLISHED BY RULE OR ORDER OF THE COMMISSION. THE SECURITIES HAVE BEEN ISSUED PURSUANT TO AN EXEMPTION FROM THE REGISTRATION REQUIREMENT OF THE PENNSYLVANIA SECURITIES ACT OF 1972. NO SUBSEQUENT RESALE OR OTHER DISPOSITION OF THE SECURITIES MAY BE MADE WITHIN 12 MONTHS FOLLOWING THEIR INITIAL SALE IN THE ABSENCE OF AN EFFECTIVE REGISTRATION, EXCEPT IN ACCORDANCE WITH WAIVERS ESTABLISHED BY RULE OR ORDER OF THE COMMISSION, AND THEREAFTER ONLY PURSUANT TO AN EFFECTIVE REGISTRATION OR EXEMPTION. 40. NOTICE TO RHODE ISLAND RESIDENTS ONLY: THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE DEPARTMENT OF BUSINESS REGULATION OF THE STATE OF RHODE ISLAND NOR HAS THE DIRECTOR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL. 41. NOTICE TO SOUTH CAROLINA RESIDENTS ONLY: THESE SECURITIES ARE BEING OFFERED PURSUANT TO A CLAIM OF EXEMPTION UNDER THE SOUTH CAROLINA UNIFORM SECURITIES ACT. A REGISTRATION STATEMENT RELATING TO THESE SECURITIES HAS NOT BEEN FILED WITH THE SOUTH CAROLINA SECURITIES COMMISSIONER. THE COMMISSIONER DOES NOT RECOMMEND OR ENDORSE THE PURCHASE OF ANY SECURITIES, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF THIS PRIVATE PLACEMENT MEMORANDUM. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

- 13. Confidential Private Placement Memorandum • Regulation D Rule 506(c) Page 13 Convertible Preferred Membership Units 42. NOTICE TO SOUTH DAKOTA RESIDENTS ONLY: THESE SECURITIES ARE BEING OFFERED FOR SALE IN THE STATE OF SOUTH DAKOTA PURSUANT TO AN EXEMPTION FROM REGISTRATION UNDER THE SOUTH DAKOTA BLUE SKY LAW, CHAPTER 47-31, WITH THE DIRECTOR OF THE DIVISION OF SECURITIES OF THE DEPARTMENT OF COMMERCE AND REGULATION OF THE STATE OF SOUTH DAKOTA. THE EXEMPTION DOES NOT CONSTITUTE A FINDING THAT THIS MEMORANDUM IS TRUE, COMPLETE, AND NOT MISLEADING, NOR HAS THE DIRECTOR OF THE DIVISION OF SECURITIES PASSED IN ANY WAY UPON THE MERITS OF, RECOMMENDED, OR GIVEN APPROVAL TO THESE SECURITIES. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. 43. NOTICE TO TENNESSEE RESIDENT ONLY: IN MAKING AN INVESTMENT DECISION INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE ISSUER AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED. THESE SECURITIES HAVE NOT BEEN RECOMMENDED BY ANY FEDERAL OR STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY. FURTHERMORE, THE FOREGOING AUTHORITIES HAVE NOT CONFIRMED THE ACCURACY OR DETERMINED THE ADEQUACY OF THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. THESE SECURITIES ARE SUBJECT TO RESTRICTIONS ON TRANSFERABILITY AND RESALE AND MAY NOT BE TRANSFERRED OR RESOLD. EXCEPT AS PERMITTED UNDER THE SECURITIES ACT OF 1933, AS AMENDED AND THE APPLICABLE STATE SECURITIES LAWS, PURSUANT TO REGISTRATION OR EXEMPTION THEREFROM. INVESTORS SHOULD BE AWARE THAT THEY MAY BE REQUIRED TO BEAR THE FINANCIAL RISK OF THIS INVESTMENT FOR AN INDEFINITE PERIOD OF TIME. 44. NOTICE TO TEXAS RESIDENTS ONLY: THE SECURITIES OFFERED HEREUNDER HAVE NOT BEEN REGISTERED UNDER APPLICABLE TEXAS SECURITIES LAWS AND, THEREFORE, ANY PURCHASER THEREOF MUST BEAR THE ECONOMIC RISK OF THE INVESTMENT FOR AN INDEFINITE PERIOD OF TIME BECAUSE THE SECURITIES CANNOT BE RESOLD UNLESS THEY ARE SUBSEQUENTLY REGISTERED UNDER SUCH SECURITIES LAWS OR AN EXEMPTION FROM SUCH REGISTRATION IS AVAILABLE. FURTHER, PURSUANT TO §109.13 UNDER THE TEXAS SECURITIES ACT, THE COMPANY IS REQUIRED TO APPRISE PROSPECTIVE INVESTORS OF THE FOLLOWING: A LEGEND SHALL BE PLACED, UPON ISSUANCE, ON CERTIFICATES REPRESENTING SECURITIES PURCHASED HEREUNDER, AND ANY PURCHASER HEREUNDER SHALL BE REQUIRED TO SIGN A WRITTEN AGREEMENT THAT HE WILL NOT SELL THE SUBJECT SECURITIES WITHOUT REGISTRATION UNDER APPLICABLE SECURITIES LAWS, OR EXEMPTIONS THEREFROM. 45. NOTICE TO UTAH RESIDENTS ONLY: THESE SECURITIES ARE BEING OFFERED IN A TRANSACTION EXEMPT FROM THE REGISTRATION REQUIREMENTS OF THE UTAH SECURITIES ACT. THE SECURITIES CANNOT BE TRANSFERRED OR SOLD EXCEPT IN TRANSACTIONS WHICH ARE EXEMPT UNDER THE ACT OR PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE ACT OR IN A TRANSACTION WHICH IS OTHERWISE IN COMPLIANCE WITH THE ACT. 46. NOTICE TO VERMONT RESIDENTS ONLY: THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES DIVISION OF THE STATE OF VERMONT NOR HAS THE COMMISSIONER PASSED UPON THE ACCURACY OR ADEQUACY OF THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL. 47. NOTICE TO VIRGINIA RESIDENTS ONLY: IF AN INVESTOR ACCEPTS AN OFFER TO PURCHASE ANY OF THE SECURITIES, THE INVESTOR IS HEREBY ADVISED THE SECURITIES WILL BE SOLD TO AND ACQUIRED BY IT/HIM/HER IN A TRANSACTION UNDER SECTION 13.1-514 OF THE VIRGINIA SECURITIES ACT AND MAY NOT BE RE-OFFERED FOR SALE, TRANSFERRED, OR RESOLD EXCEPT IN COMPLIANCE WITH SUCH ACT AND APPLICABLE RULES PROMULGATED THEREUNDER. 48. NOTICE TO WASHINGTON RESIDENTS ONLY: THE ADMINISTRATOR OF SECURITIES HAS

- 14. Confidential Private Placement Memorandum • Regulation D Rule 506(c) Page 14 Convertible Preferred Membership Units NOT REVIEWED THE OFFERING OR PRIVATE PLACEMENT MEMORANDUM AND THE SECURITIES HAVE NOT BEEN REGISTERED IN RELIANCE UPON THE SECURITIES ACT OF WASHINGTON, CHAPTER 21.20 RCW, AND THEREFORE, CANNOT BE RESOLD UNLESS THEY ARE REGISTERED UNDER THE SECURITIES ACT OF WASHINGTON, CHAPTER 21.20 RCW, OR UNLESS AN EXEMPTION FROM REGISTRATION IS MADE AVAILABLE. 49. NOTICE TO WEST VIRGINIA RESIDENTS ONLY: IF AN INVESTOR ACCEPTS AN OFFER TO PURCHASE ANY OF THE SECURITIES, THE INVESTOR IS HEREBY ADVISED THE SECURITIES WILL BE SOLD TO AND ACQUIRED BY IT/HIM/HER IN A TRANSACTION EXEMPT FROM REGISTRATION UNDER SECTION 15.06(b)(9) OF THE WEST VIRGINIA SECURITIES LAW AND MAY NOT BE REOFFERED FOR SALE, TRANSFERRED, OR RESOLD EXCEPT IN COMPLIANCE WITH SUCH ACT AND APPLICABLE RULES PROMULGATED THEREUNDER. 50. NOTICE TO WISCONSIN RESIDENTS ONLY: IN ADDITION TO THE INVESTOR SUITABILITY STANDARDS THAT ARE OTHERWISE APPLICABLE, ANY INVESTOR WHO IS A WISCONSIN RESIDENT MUST HAVE A NET WORTH (EXCLUSIVE OF HOME, FURNISHINGS AND AUTOMOBILES) IN EXCESS OF THREE AND ONE-THIRD (3 1/3) TIMES THE AGGREGATE AMOUNT INVESTED BY SUCH INVESTOR IN THE SHARES OFFERED HEREIN. 51. FOR WYOMING RESIDENTS ONLY: ALL WYOMING RESIDENTS WHO SUBSCRIBE TO PURCHASE SHARES OFFERED BY THE COMPANY MUST SATISFY THE FOLLOWING MINIMUM FINANCIAL SUITABILITY REQUIREMENTS IN ORDER TO PURCHASE SHARES: (1) A NET WORTH (EXCLUSIVE OF HOME, FURNISHINGS AND AUTOMOBILES) OF TWO HUNDRED FIFTY THOUSAND DOLLARS ($250,000 ); AND (2) THE PURCHASE PRICE OF SHARES SUBSCRIBED FOR MAY NOT EXCEED TWENTY PERCENT (20%) OF THE NET WORTH OF THE SUBSCRIBER; AND (3) "TAXABLE INCOME" AS DEFINED IN SECTION 63 OF THE INTERNAL REVENUE CODE OF 1986, AS AMENDED, DURING THE LAST TAX YEAR AND ESTIMATED "TAXABLE INCOME" DURING THE CURRENT TAX YEAR SUBJECT TO A FEDERAL INCOME TAX RATE OF NOT LESS THAN THIRTY-THREE PERCENT (33%). IN ORDER TO VERIFY THE FOREGOING, ALL SUBSCRIBERS WHO ARE WYOMING RESIDENTS WILL BE REQUIRED TO REPRESENT IN THE SUBSCRIPTION AGREEMENT THAT THEY MEET THESE WYOMING SPECIAL INVESTOR SUITABILITY REQUIREMENTS. EACH PROSPECTIVE INVESTOR WILL BE GIVEN AN OPPORTUNITY TO ASK QUESTIONS OF, AND RECEIVE ANSWERS FROM, MANAGEMENT OF THE COMPANY CONCERNING THE TERMS AND CONDITIONS OF THIS OFFERING AND TO OBTAIN ANY ADDITIONAL INFORMATION, TO THE EXTENT THE COMPANY POSSESSES SUCH INFORMATION OR CAN ACQUIRE IT WITHOUT UNREASONABLE EFFORTS OR EXPENSE, NECESSARY TO VERIFY THE ACCURACY OF THE INFORMATION CONTAINED IN THIS MEMORANDUM. IF YOU HAVE ANY QUESTIONS WHATSOEVER REGARDING THIS OFFERING, OR DESIRE ANY ADDITIONAL INFORMATION OR DOCUMENTS TO VERIFY OR SUPPLEMENT THE INFORMATION CONTAINED IN THIS MEMORANDUM, PLEASE WRITE OR CALL: INTERNATIONAL METALS TRADING, LLC Ÿ C/O IAN PARKER, EXECUTIVE DIRECTOR Ÿ 81 PROSPECT ST, 8 FLOOR Ÿ BROOKLYN, NY 11201 Ÿ PH: 866- 923-0182.

- 15. Confidential Private Placement Memorandum • Regulation D Rule 506(c) Page 15 Convertible Preferred Membership Units TABLE OF CONTENTS I. Jurisdictional (NASAA) Legends ..................................................................................................................................................................... 6 II. Summary of the Offering .............................................................................................................................................................................. 16 A. The Company.............................................................................................................................................................................................. 23 B. The Benefits of LLC Membership .............................................................................................................................................................. 23 C. Operations ................................................................................................................................................................................................... 23 E. The Offering ................................................................................................................................................................................................ 23 F. Risk Factors ................................................................................................................................................................................................. 24 G. Use of Proceeds........................................................................................................................................................................................... 24 H. Minimum Offering Proceeds - Escrow of Subscription Proceeds.............................................................................................................. 24 I. Convertible Preferred Units .......................................................................................................................................................................... 24 J. Registrar........................................................................................................................................................................................................ 24 K. Subscription Period..................................................................................................................................................................................... 24 III. Business Summary ........................................................................................................................................................................................ 40 III. Requirements for Purchasers ..................................................................................................................................................................... 40 A. General Suitability Standards ..................................................................................................................................................................... 40 B. Accredited Investors.................................................................................................................................................................................... 40 C. Other Requirements..................................................................................................................................................................................... 41 IV. Forward Looking Information ................................................................................................................................................................... 41 V. Risk Factors.................................................................................................................................................................................................... 41 A. Risks Related to Our Business.................................................................................................................................................................. ..38 B. Risk Related to This Offerring.................................................................................................................................................................... 42 VI. Use Of Proceeds............................................................................................................................................................................................ 48 A. Sale of Equity.............................................................................................................................................................................................. 48 B. Offering Expenses & Commissions ............................................................................................................................................................ 48 C. Corporate Application of Proceeds ............................................................................................................................................................. 48 D. Total Use of Proceeds ................................................................................................................................................................................. 48 VII. Management................................................................................................................................................................................................. 49 VIII. Management Compensation....................................................................................................................................................................... 51 IX. Board of Advisors......................................................................................................................................................................................... 51 X. Dilution........................................................................................................................................................................................................... 51 XI. Capitalization Table & Dilution ................................................................................................................................................................. 53 XII. Membership UNIT OPTION AGREEMENTS........................................................................................................................................ 55 XIII. Litigation ...................................................................................................................................................................................................... 55 XIV. Description of Units..................................................................................................................................................................................... 55 XV. Transfer Agent and Registrar.................................................................................................................................................................... 56 XVI. Plan of Placement ........................................................................................................................................................................................ 58 A. Escrow of Subscription Funds .................................................................................................................................................................... 58 B. How to Subscribe for Units......................................................................................................................................................................... 58 XVII. Additional Information............................................................................................................................................................................... 58 Exhibits and Addendums: Exhibit A - International Metals Trading, LLC. Operating Agreement Addendum I - Subscription Agreement Addendum II - Investor Suitability Questionnaire *Please note Addendums are separately attached

- 16. Confidential Private Placement Memorandum • Regulation D Rule 506(c) Page 16 Convertible Preferred Membership Units II. SUMMARY OF THE OFFERING Investors should read this memorandum carefully before making any investment decisions regarding the Company and should pay particular attention to the information contained under the heading “Risk Factors.” Additionally, Investors should consult their own advisors in order to fully comprehend the consequences of investing in the Company. The following summary does not purport to be complete and is qualified in its entirety by more detailed information appearing elsewhere in this Memorandum and the Exhibits hereto. In this memorandum, “International Metals Trading, LLC,” “International Metals Trading,” “Company,” “company,” “we,” “our,” and “us” refer to International Metals Trading, LLC. “You”, “Prospective Investor”, “Prospective Purchaser”, and “Purchaser” refers to the reader of this memorandum. This summary highlights the information contained elsewhere in this memorandum. Because this is only a summary, it does not contain all of the information that may be important to you. For a more complete understanding of this offering, Company encourages you to read this entire memorandum and the documents to which Company refers you. You should read the following memorandum together with the more detailed information and financial statements and the notes to those statements appearing elsewhere in this memorandum. GENERAL: International Metals Trading, LLC (the “Company”) purchases precious and base metals on a wholesale basis from direct outlets such as mills or secondary precious metals recycling sources. The Company’s customers include the largest OEM manufacturers, refiners, primary mines and some the largest construction companies in the country. The Company’s industry experts manage the various commodity risks by hedging margins through disciplined capital preservation mechanisms. Using proper forward selling techniques and construction contracts helps ensure that the Company’s balance sheet of the transactions will not fall below the initial investment. In most cases, the Company’s principal in these transactions will be collateralized by 120% of the value of said principal, in its notional amount, in precious and base metals. There are other safeguards in place to further protect investor capital such as content and transport insurance, bonding and liens. The Company’s primary concern and objective is to protect Company capital through disciplined capital preservation mechanisms. All metals materials that are bought and sold are hedged through proper forward selling agreements using the futures market (Chicago Mercantile Exchange) thus greatly reducing commodity risk. Type of Security: Series A Convertible Preferred Unit, $4.00 per Unit (the “Preferred Units”), initially convertible on a one-to-one (the “Conversions Ratio”) basis into Units of the Company’s Common Units (the “Common Units”). Capitalization: Purpose: Company has authorized 12,000,000 Common Units and 3,500,000 Preferred Units. Prior to this offering, current owners hold 6,000,000 Common Units and have reserved another 500,000 Common Units for key parties. If all 3,500,000 Preferred Units are sold and converted the Company would have 10,875,000 Common Units outstanding. Acquisition and trading of precious and base metals on, a wholesale basis, from direct outlets such as mills or secondary precious metals recycling sources. Our customers include the largest OEM manufacturers, refiners, primary mines and some the largest construction firms in the country. TERMS OF PREFERRED UNITS: Liquidation Preference: Upon the occurrence of any (i) liquidation, dissolution or winding up of the Company, (ii) a merger or consolidation (other than one in which

- 17. Confidential Private Placement Memorandum • Regulation D Rule 506(c) Page 17 Convertible Preferred Membership Units Unitholders of the Company own a majority by voting power of the outstanding Units of the surviving or acquiring corporation), or (iii) a sale, lease, transfer or other disposition of all or substantially all of the assets of the Company (the events described in the foregoing clauses (ii) and (iii) are each referred to herein as a “Deemed Liquidation Event”), the holders of the Preferred Units would receive an amount per Preferred Unit, in preference to the holders of the Common Unit, equal to the Original Purchase Price, plus accrued but unpaid dividends on each Unit of the Preferred Units. Thereafter, the Preferred Units would participate with the Common Unit on an as-converted to Common Unit basis. Dividends: Dividends on the Preferred Units would be cumulative and accrue, in preference to any dividend on Units of the Common Unit, at a rate determined by the Board of Managers on an annual basis (but not less than 3% per annum) of the Original Purchase Price, compounded quarterly. Dividends on the Preferred Units would be payable upon a Deemed Liquidation Event or upon conversion or redemption. For any other dividends or distributions, participation with Common Unit on an as- converted basis. Warrant Coverage: The Company shall provide Unitholders with 25% Warrant Coverage at a strike price of 150% of the current offering price per Unit (current Unit price $4.00 gives a Warrant strike price of $6.00). Warrants shall be good for the earlier of (i) 5 years or (ii) exercisable within 6 months of the next round of equity financing that is priced at or above the strike (at or in the money) or (iii) exercisable prior to any announced merger or acquisition that is priced at or above the strike (at or in the money) so long as Unithold has at least 3 month prior notice of such an event. Warrants are the option to purchase Common Units at the Strike of $6.00. Warrant Coverage shall be calculated by taking the total amount of a Unitholder’s Preferred Units and dividing them by 4; any fractional numbers in the solution shall be ignored. For example, a Unitholder of 57,787 Preferred Units would be calculated as follows: 57,787 ÷ 4 = 14,446.75. Thus the Unitholder would be issued 14,446 Warrants. Optional Conversion: The Preferred Units would initially convert on a one for one basis into Units of the Common Unit at any time at the option of the holder, subject to adjustments for Unit dividends, splits, combinations and similar events and as described below under the caption “Anti-dilution Provisions.” Mandatory Conversion: Each Unit of the Preferred Units would automatically be converted into Units of the Common Unit at the then applicable conversion rate (i) upon a public offering of Common Units or reverse merger into a public reporting entity or (ii) upon the written consent of the holders of a majority of the Preferred Units. Anti-dilution Provisions: Unless otherwise waived by the holders of at least two-thirds of the Preferred Units, in the event that the Company issues additional securities at a purchase price less than the current Preferred Units conversion price, such conversion price would be adjusted on a full ratchet basis, provided that no such adjustment would occur with respect to (i) securities issuable upon conversion of any of the Preferred Units, or as a dividend or distribution on

- 18. Confidential Private Placement Memorandum • Regulation D Rule 506(c) Page 18 Convertible Preferred Membership Units the Preferred Units; (ii) securities issued upon the conversion of any debenture, warrant, option, or other convertible security outstanding as of the date of the Initial Closing; (iii) Units of the Common Unit issuable upon a Unit split, Unit dividend, or any subdivision of Units of Common Unit; (iv) Units of the Common Unit (or options to purchase such Units of Common Unit) issued or issuable to employees or directors of, or consultants to, the Company pursuant to any plan approved by the Board, including both of the Series A Directors (as defined); (v) Units of the Common Unit issued or issuable to banks, equipment lessors pursuant to a debt financing, equipment leasing or real property leasing transaction approved by the Board, including the Series A Directors; and (vi) Units of the Common Unit issued or issuable for consideration other than cash pursuant to a technology license, business combination, strategic partnership or joint venture transaction approved by the Board, including both the Series A Directors (as defined herein). Redemption Rights: The Preferred Units would be redeemable from funds legally available for distribution at the option of holders of at least 50% of the Preferred Units commencing any time after the fourth anniversary of the Initial Closing at a price equal to the Original Purchase Price plus all accrued but unpaid dividends. Redemption would occur in three equal quarterly installments beginning 90 days after a valid election of redemption has occurred. Upon a redemption request from the holders of the required percentage of the Preferred Units, all of the Preferred Units would be redeemed (except for any holders of Units of the Preferred Units who affirmatively opt-out of such redemption). Registration Rights: Registrable Securities: All Units of the Common Unit issuable upon conversion of the Preferred Units and any other Units of the Common Unit held by the Investors would be “Registrable Securities.” Demand Registration: Upon earlier of (i) three years after the Initial Closing; or (ii) six months following an initial public offering or reverse merger (“IPO”), persons holding not less than an aggregate of 50% of Registrable Securities may demand not more than two registrations by the Company of their Units, but only if the aggregate offering price is at least $5 million. A registration would count for this purpose only if (A) not less than 75% of all Registrable Securities requested to be registered are included in the registration, or (B) it is closed, or withdrawn at the request of the demanding Investors (other than as a result of a material adverse change to the Company). Holders of Registrable Securities would have priority in all registrations over all other Units except for in registrations initiated by the Company in which case the Units being sold by the Company for its own account shall have priority. Registration on Form S-3: The holders of not less than 20% of the Registrable Securities would have the right to require the Company to register on Form S-3, if available for use by the Company, Registrable Securities for an aggregate offering price of at least $1 million. There would be no limit on the aggregate number of such Form S-3 registrations, provided that there are no more than two per year. Piggyback Registration: The holders of Registrable Securities would be entitled to “piggyback” registration rights on all registration statements of the Company, subject to the right, however, of the Company and its underwriters to reduce the number of Units proposed to be registered to a minimum of 30% on a pro

- 19. Confidential Private Placement Memorandum • Regulation D Rule 506(c) Page 19 Convertible Preferred Membership Units rata basis and to complete reduction on an IPO at the underwriter’s discretion. In all events, the Units to be registered by holders of Registrable Securities would be reduced only after all other Unitholders’ Units are reduced. Expenses: The registration expenses (exclusive of Unit transfer taxes, underwriting discounts and commissions) would be borne by the Company. The Company would also pay the reasonable fees and expenses, not to exceed $75,000, of one special counsel to represent all the participating holders of Registrable Securities. Lock-up: The Investors would agree in connection with a potential IPO, if requested by said IPO’s managing underwriter, not to sell or transfer any Units of Common Unit of the Company for a period of up to 180 days following the IPO, provided all directors and officers of the Company agree to the same restriction. Termination of Registration Rights: Upon the earlier of: (i) one (1) years after a potential IPO, (ii) a Deemed Liquidation Event, or (iii) when all Registrable Securities of an Investor are eligible to be sold without restriction under Rule 144(k) within any 90-day period. The Company may grant no future registration rights without consent of the holders of a majority of the Registrable Securities unless subordinate to the registration rights of such holders in all respects. GOVERNANCE: Voting Rights: The Preferred Units would vote together with the Common Unit on an as- converted basis, and not as a separate class. ADDITIONAL RIGHTS: Management and Information Rights: Each holder of the Preferred Units shall receive (a) during 2016 quarterly “dashboard” summary financial results, (b) in subsequent quarterly unaudited financials, (c) annually audited statements and a budget, and (d) a quarterly brief descriptive report from the CEO. Right to Participate Pro Rata in Future Rounds: All Major Investors (those investors holding 5% or more of the Company’s membership interest) would have a pro rata right, based on their percentage equity ownership in the Company (assuming the conversion of all outstanding Units of the Preferred Units into Units of the Common Unit and the exercise of all warrants and options outstanding under the Company’s Unit plans), to participate in subsequent issuances of equity securities of the Company (excluding those issuances that do not trigger operation of the adjustment described above under “Anti-dilution Provisions” and issuances in connection with acquisitions by the Company). In addition, should any Major Investor choose not to purchase its full pro rata Unit, the remaining Major Investors would have the right to purchase the remaining pro rata Units.

- 20. Confidential Private Placement Memorandum • Regulation D Rule 506(c) Page 20 Convertible Preferred Membership Units Rights of Refusal/ Co-Sale: The Company first and the Investors second would have a right of first refusal with respect to any Units of capital Unit of the Company proposed to be sold by any current Unitholder and employees holding greater than 2% of the Common Unit (assuming exercise of all options and conversion of the Preferred Units) (the “Key Holders”), with a right of oversubscription for Investors of Units unsubscribed by the other Investors. Before any Key Holder could sell Common Unit, such Key Holder would give the holders of the Preferred Units an opportunity to participate in such sale on a basis proportionate to the amount of securities held by the seller and those held by the participating Investors. OTHER: Proprietary Information, Inventions and Non-compete Agreements: Each officer, employee and consultant of the Company would enter into acceptable proprietary information, inventions and non-compete agreements. Representations and Warranties: The Unit Purchase Agreement would contain customary representations including, without limitation, organization and qualification, capitalization, intellectual property, authorization, execution and delivery, validity and enforceability of agreements, issuance of the Preferred Unit, no litigation, compliance with laws, no governmental consent, taxes, no conflict with agreements and charter provisions, taxes, ERISA, employment and labor regulations, no undisclosed liabilities, no affiliate transactions, no defaults and no material adverse change. Closing: On or before December 31, 2015 Confidentiality: Prospective Investors shall not disclose the terms of this Summary of Offering to any person or entity except for the accountants, attorneys and other professional advisors of the investor.

- 21. Confidential Private Placement Memorandum • Regulation D Rule 506(c) Page 21 Convertible Preferred Membership Units [REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

- 22. Confidential Private Placement Memorandum • Regulation D Rule 506(c) Page 22 Convertible Preferred Membership Units Summary Financial Data AVAILABLE INFORMATION Company is not presently subject to the reporting and information requirements of the Securities Exchange Act of 1934 (the “Exchange Act”), and therefore does not file reports, proxy statements and other statements. However, Company shall provide its investors with quarterly and annual reports. Selected Financial Information: The business summary developed by the Company contains certain projections with respect to its anticipated new capital for current operations. The financial projections and the assumptions upon which they are based represent forecasts of results that might be achieved should all the stated assumptions contained therein be realized. You should read the following summary financial data together with our Audited Financial Statements to better understand the track record that form the basis of our assumption. Management has a successful track record in both the precious and base metal trading. The assumptions below include both the precious and base metal business lines. Key Assumptions: (1) 2015 is project thru the FYE. The Company has approximately $14 million in sales thru the 3rd quarter with a gross profit of approximately $765,000. (2) Company’s steel fabrication business started in August of 2015. Current assumptions are based on work that has been contracted for 2015 and 2016. 2017 and 2018 assume generally accepted industry margins and project work (work not yet contracted). Tons sold annually are projected to be 67,500, 112,500, and 140,000 in 2016, 2017, and 2018 respectively. (3) BIG Sky is projected to sell annually 27,600, 79,200, and 79,200 in 2016, 2017, and 2018 respectively. This based on intense industry research for the Big Sky target markets. [REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

- 23. Confidential Private Placement Memorandum • Regulation D Rule 506(c) Page 23 Convertible Preferred Membership Units B. The Company International Metals Trading, LLC (“International Metals Trading”, or the “Company”), began operations in October 2013, with the purpose of trading precious and base metals. The Company’s legal structure was formed as a limited liability company (LLC) under the laws of the State of Delaware on October 2013. Its principal offices are presently located at 81 Prospect St, 8th Floor Brooklyn, NY 11201. The Company’s telephone number is (866) 923-0182. The Managing Directors of the Company are Ian Parker, Joseph Kalinowski, and Ned Moulton (“Management”). C. The Benefits of LLC Membership The limited liability company (LLC) is a relatively new form of doing business in the United States (in 1988 all 50 states enacted LLC laws). The best way to describe an LLC is to explain what it is not. An LLC is not a corporation, a partnership nor is it a sole proprietorship. The LLC is a hybrid legal structure that combines the characteristics of a corporate structure and a partnership structure. It is a separate legal entity like a corporation but it has entitlement to be treated as a partnership for tax purposes and therefore carries with it certain tax benefits for the investors. The owners and investors are called members and can be virtually any entity including individuals (domestic or foreign), corporations, other LLCs, trusts, pension plans etc. Unlike corporate stocks and shares, members purchase Convertible Preferred Units. Members who hold the majority of the Units maintain controlling management of the LLC as specified in the LLC operating agreement. The primary advantage of an LLC is limiting the liability of its members. Unless personally guaranteed, members are not personally liable for the debts and obligations of the LLC. Additionally, “pass-through” or “flow-through” taxation is available, meaning that (generally speaking) the earnings of an LLC are not subject to double taxation unlike that of a “standard” corporation. However, they are treated like the earnings from partnerships, sole proprietorships and S corporations with an added benefit for all of its members. There is greater flexibility in structuring the LLC than is ordinarily the case with a corporation, including the ability to divide ownership and voting rights in unconventional ways while still enjoying the benefits of “pass-through” taxation. D. Operations International Metals Trading, LLC (the “Company”) purchases precious and base metals on a wholesale basis from direct outlets such as mills or secondary precious metals recycling sources. The Company’s customers include the largest OEM manufacturers, refiners, primary mines and some the largest construction companies in the country. The Company’s industry experts manage the various commodity risks by hedging margins through disciplined capital preservation mechanisms. Using proper forward selling techniques and construction contracts helps ensure that the Company’s balance sheet of the transactions will not fall below the initial investment. In most cases, the Company’s principal in these transactions will be collateralized by 120% of the value of said principal, in its notional amount, in precious and base metals. There are other safeguards in place to further protect investor capital such as content and transport insurance, bonding and liens. The Company’s primary concern and objective is to protect Company capital through disciplined capital preservation mechanisms. All metals materials that are bought and sold are hedged through proper forward selling agreements using the futures market (Chicago Mercantile Exchange) thus greatly reducing commodity risk. The Company believes that continued successful execution of its business strategy should provide the opportunity for leverage within the entity, allowing for enhanced returns while also mitigating downside risk through high quality hedging and risk management. E. The Offering The Company is offering a minimum of 500,000 and a maximum of 3,500,000 Units at a price of $4.00 per Unit, $.001 par value per unit. Upon completion of the Offering between 7,000,000 and 10,000,000 Common Units will be outstanding on a fully diluted basis. Each Purchaser of Preferred Units must execute a Subscription Agreement making certain representations and warranties to the Company, including such Purchaser’s qualifications as an Accredited Investor as defined by the Securities and Exchange Commission in Rule 501(a) of Regulation D promulgated. See “REQUIREMENTS FOR PURCHASERS” section.

- 24. Confidential Private Placement Memorandum • Regulation D Rule 506(c) Page 24 Convertible Preferred Membership Units F. Risk Factors See “RISK FACTORS” section in this Memorandum for certain factors that could adversely affect an investment in the Units. Those factors include, but are not limited to unanticipated obstacles to execution of the Business Plan, general economic factors, and other unanticipated metal commodity risk. G. Use of Proceeds If the entire offering amount of 3,500,000 Series A Convertible Preferred Units is sold, Company estimates that the net proceeds will be approximately $12,740,000 after deducting the estimated offering expenses. Company will use the net proceeds from this for commodity trading & hedging activities, which will result in cash flow for the company. Management will have broad discretion in applying the Company’s net proceeds of this offering within commodity activities that meet the criteria explained within the business summary or other such similar opportunities that are backed by assets and have attractive economics. See “USE OF PROCEEDS” section. H. Minimum Offering Proceeds - Escrow of Subscription Proceeds The Company has set a minimum offering proceeds figure of $2,000,000 (the “minimum offering proceeds”) for this Offering. The Company has established an Investment Holding Account with Cortland Capital Market Services LLC, 225 W. Washington St. 21st Floor, Chicago, IL 60606, into which the minimum offering proceeds will be placed. At least 500,000 Units must be sold for $2,000,000 before such proceeds will be released from the escrow account and utilized by the Company. After the minimum number of Units is sold, all subsequent proceeds from the sale of Units will be delivered directly to the Company. See “PLAN OF PLACEMENT - ESCROW ACCOUNT ARRANGEMENT” section. I. Convertible Preferred Units Upon the sale of the maximum number of Units from this Offering, the number of issued and outstanding units of the Company’s stock will be held as follows: Present Members 60% New Members 40% J. Registrar The Company will serve as its own registrar and transfer agent with respect to its Convertible Preferred Units. K. Subscription Period The Offering will terminate on the earliest of: (a) the date the Company, in its discretion, elects to terminate, or (b) the date upon which all Units have been sold, or (c) December 31, 2015, or such date as may be extended from time to time by the Company, but not later than 180 days thereafter (the “Offering Period”.) [REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]