Taxing the Ultra Rich: A Little History

•

3 j'aime•823 vues

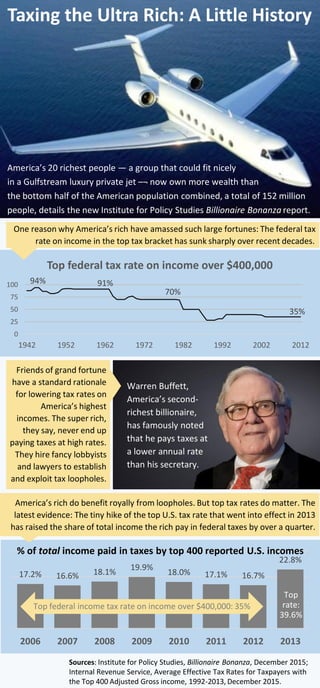

America’s 20 richest people — a group that could fit nicely in a Gulfstream luxury private jet – now own more wealth than the bottom half of the American population combined, a total of 152 million people, details the new Institute for Policy Studies Billionaire Bonanza report. One reason why America’s rich have amassed such large fortunes: The federal tax rate on income in the top tax bracket has sunk sharply over recent decades. This infographic also appears in Too Much, the inequality monthly. Check www.toomuchonline.org for more.

Signaler

Partager

Signaler

Partager

Télécharger pour lire hors ligne

Recommandé

Contenu connexe

Tendances

Tendances (15)

9 Facts about Taxes, which the IRS doesn't Want You to Know

9 Facts about Taxes, which the IRS doesn't Want You to Know

What If Danville Gets a Casino? Risks, Rewards, Uncertainties

What If Danville Gets a Casino? Risks, Rewards, Uncertainties

Similaire à Taxing the Ultra Rich: A Little History

Similaire à Taxing the Ultra Rich: A Little History (20)

Fund Our Future Tax The Rich Invest In Our New York

Fund Our Future Tax The Rich Invest In Our New York

2019 Election| Top 1% (Wealthiest) - Canada - June 2019

2019 Election| Top 1% (Wealthiest) - Canada - June 2019

Income Tax Tips for PFMs Working with Military Families

Income Tax Tips for PFMs Working with Military Families

Economic Intervention: Deprogramming Conservatives

Economic Intervention: Deprogramming Conservatives

Americans abroad taxes and global financial accountability - awc-ff-april 2012

Americans abroad taxes and global financial accountability - awc-ff-april 2012

Stephen Harper and CPC - Fiscal Record - June 2018

Stephen Harper and CPC - Fiscal Record - June 2018

Corporate tax reform and labor market implications

Corporate tax reform and labor market implications

Plus de Institute for Policy Studies

Plus de Institute for Policy Studies (17)

Minimum Wage, Maximum Wage: New Paths to a More Equal America

Minimum Wage, Maximum Wage: New Paths to a More Equal America

Extreme Inequality: Starting a Strategic Conversation

Extreme Inequality: Starting a Strategic Conversation

Dernier

Mitochondrial Fusion Vital for Adult Brain Function and Disease Understanding...

Mitochondrial Fusion Vital for Adult Brain Function and Disease Understanding...The Lifesciences Magazine

Dernier (12)

Mitochondrial Fusion Vital for Adult Brain Function and Disease Understanding...

Mitochondrial Fusion Vital for Adult Brain Function and Disease Understanding...

World Economic Forum : The Global Risks Report 2024

World Economic Forum : The Global Risks Report 2024

Geostrategic significance of South Asian countries.ppt

Geostrategic significance of South Asian countries.ppt

Taxing the Ultra Rich: A Little History

- 1. One reason why America’s rich have amassed such large fortunes: The federal tax rate on income in the top tax bracket has sunk sharply over recent decades. Sources: Institute for Policy Studies, Billionaire Bonanza, December 2015; Internal Revenue Service, Average Effective Tax Rates for Taxpayers with the Top 400 Adjusted Gross income, 1992-2013, December 2015. Friends of grand fortune have a standard rationale for lowering tax rates on America’s highest incomes. The super rich, they say, never end up paying taxes at high rates. They hire fancy lobbyists and lawyers to establish and exploit tax loopholes. Taxing the Ultra Rich: A Little History America’s 20 richest people — a group that could fit nicely in a Gulfstream luxury private jet –¬ now own more wealth than the bottom half of the American population combined, a total of 152 million people, details the new Institute for Policy Studies Billionaire Bonanza report. 94% 91% 70% 35% 0 25 50 75 100 1942 1952 1962 1972 1982 1992 2002 2012 Top federal tax rate on income over $400,000 Warren Buffett, America’s second- richest billionaire, has famously noted that he pays taxes at a lower annual rate than his secretary. America’s rich do benefit royally from loopholes. But top tax rates do matter. The latest evidence: The tiny hike of the top U.S. tax rate that went into effect in 2013 has raised the share of total income the rich pay in federal taxes by over a quarter. 17.2% 16.6% 18.1% 19.9% 18.0% 17.1% 16.7% 22.8% 2006 2007 2008 2009 2010 2011 2012 2013 % of total income paid in taxes by top 400 reported U.S. incomes Top federal income tax rate on income over $400,000: 35% Top rate: 39.6%